W

WThe 1970s energy crisis occurred when the Western world, particularly the United States, Canada, Western Europe, Australia, and New Zealand, faced substantial petroleum shortages, real and perceived, as well as elevated prices. The two worst crises of this period were the 1973 oil crisis and the 1979 energy crisis, when the Yom Kippur War and the Iranian Revolution triggered interruptions in Middle Eastern oil exports.

W

WThe 1979 Oil Crisis, also known as the 1979 Oil Shock or Second Oil Crisis, was an energy crisis caused by a drop in oil production in the wake of the Iranian Revolution. Although the global oil supply only decreased by approximately four percent, the oil markets reaction raised the price of crude oil drastically over the next 12 months, more than doubling it to $39.50 per barrel. The spike in price caused fuel shortages and long lines at gas stations similar to the 1973 oil crisis.

W

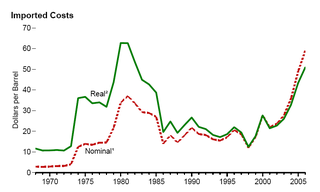

WThe 1980s oil glut was a serious surplus of crude oil caused by falling demand following the 1970s energy crisis. The world price of oil had peaked in 1980 at over US$35 per barrel ; it fell in 1986 from $27 to below $10. The glut began in the early 1980s as a result of slowed economic activity in industrial countries due to the crises of the 1970s, especially in 1973 and 1979, and the energy conservation spurred by high fuel prices. The inflation-adjusted real 2004 dollar value of oil fell from an average of $78.2 in 1981 to an average of $26.8 per barrel in 1986.

W

WFrom the mid-1980s to September 2003, the inflation-adjusted price of a barrel of crude oil on NYMEX was generally under US$25/barrel. During 2003, the price rose above $30, reached $60 by 11 August 2005, and peaked at $147.30 in July 2008. Commentators attributed these price increases to many factors, including Middle East tension, soaring demand from China, the falling value of the U.S. dollar, reports showing a decline in petroleum reserves, worries over peak oil, and financial speculation.

W

WIn May 2020, Iran sent five oil tankers—Forest, Fortune, Petunia, Faxon, and Clavel—all under the flag of Iran, to Venezuela, followed by another tanker, Golsan, sent in June 2020. Since the collapse of Venezuela's oil refining industry and 2019 sanctions imposed by the United States preventing fuel suppliers from sending gasoline to Venezuela, the country is experiencing a chronic shortage of gasoline. The Iranian tankers sent in May carried 1.53 million barrels of Iranian gasoline, while Golsan was expected to contain 190,000 to 345,000 barrels. All the tankers were loaded at a gasoline refinery near Bandar Abbas, and were escorted by the Venezuelan navy after U.S. threats of intervention.

W

WThe Russia–Saudi Arabia oil price war of 2020 is an economic war triggered in March 2020 by Saudi Arabia in response to Russia's refusal to reduce oil production in order to keep prices for oil at moderate level. This economic conflict resulted in a sheer drop of oil price over the spring of 2020.

W

WBig Oil is a name used to describe the world's six or seven largest publicly traded oil and gas companies, also known as supermajors. The term emphasizes their economic power and influence on politics, particularly in the United States. Big oil is often associated with the fossil fuels lobby and also used to refer to the industry as a whole in a pejorative or derogatory manner.

W

WThe usage and pricing of gasoline results from factors such as crude oil prices, processing and distribution costs, local demand, the strength of local currencies, local taxation, and the availability of local sources of gasoline (supply). Since fuels are traded worldwide, the trade prices are similar. The price paid by consumers largely reflects national pricing policy. Some regions, such as Europe and Japan, impose high taxes on gasoline (petrol); others, such as Saudi Arabia and Venezuela, subsidize the cost. Western countries have among the highest usage rates per person. The largest consumer is the United States, which used an average of 368 million US gallons each day in 2011.

W

WThe Indian Oil Institute of Petroleum Management is a training institute of Indian Oil Corporation set up in 1995 at Gurgaon, a city in the state of Haryana, India. It conducts advanced management education programmes in collaboration with premier business schools and top line professionals. IiPM has been conducting global standard international business management programmes for executive along with various management development programmes.

W

WThe Intercontinental Exchange (ICE) is an American Fortune 500 company formed in 2000 that operates global exchanges, clearing houses and provides mortgage technology, data and listing services. The company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada and Europe, the Liffe futures exchanges in Europe, the New York Stock Exchange, equity options exchanges and OTC energy, credit and equity markets.

W

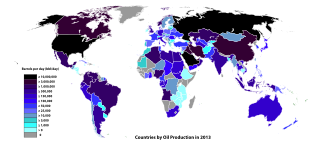

WThis is a list of countries by oil consumption. In 2020 total worldwide oil consumption is expected to drop by 9% year over year compared to 2019 due to the COVID-19 pandemic according to the International Energy Agency (IEA).

W

WThis is a list of countries by proven oil reserves. Proven reserves are those quantities of petroleum which, by analysis of geological and engineering data, can be estimated, with a high degree of confidence, to be commercially recoverable from a given date forward from known reservoirs and under current economic conditions.

W

WThis article includes a chart representing proven reserves, production, consumption, exports and imports of oil by country.

W

WThe Organization of the Petroleum Exporting Countries is an intergovernmental organization of 13 nations. Founded on 14 September 1960 in Baghdad by the first five members, it has since 1965 been headquartered in Vienna, Austria, although Austria is not an OPEC member state. As of September 2018, the 13 member countries accounted for an estimated 44 percent of global oil production and 81.5 percent of the world's "proven" oil reserves, giving OPEC a major influence on global oil prices that were previously determined by the so-called "Seven Sisters" grouping of multinational oil companies. A larger group called OPEC+ was formed in late 2016, to have more control on global crude oil market. The demand for OPEC oil has fallen to a 30-year low in second quarter of 2020.

W

WPetrodollar recycling is the international spending or investment of a country's revenues from petroleum exports ("petrodollars"). It generally refers to the phenomenon of major petroleum-exporting nations, mainly the OPEC members plus Russia and Norway, earning more money from the export of crude oil than they could efficiently invest in their own economies. The resulting global interdependencies and financial flows, from oil producers back to oil consumers, can reach a scale of hundreds of billions of US dollars per year – including a wide range of transactions in a variety of currencies, some pegged to the US dollar and some not. These flows are heavily influenced by government-level decisions regarding international investment and aid, with important consequences for both global finance and petroleum politics. The phenomenon is most pronounced during periods when the price of oil is historically high.

W

WPetroleum pricing in Nova Scotia is based on the Petroleum Products Pricing Act which governs the wholesale and minimum and maximum price of gasoline and diesel fuels that are authorised in Nova Scotia.

W

WThe Professional Petroleum Data Management Association is a global, not-for-profit organization that works collaboratively within the petroleum industry to create and promote standards and best practices for data management. The Association’s vision is the global adoption of data management standards and best practices throughout the upstream petroleum industry.

W

WThe price of oil, or the oil price, generally refers to the spot price of a barrel of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPEC Reference Basket, Tapis crude, Bonny Light, Urals oil, Isthmus and Western Canadian Select (WCS). There is a differential in the price of a barrel of oil based on its grade—determined by factors such as its specific gravity or API gravity and its sulfur content—and its location—for example, its proximity to tidewater and refineries. Heavier, sour crude oils lacking in tidewater access—such as Western Canadian Select—are less expensive than lighter, sweeter oil—such as WTI.

W

WS&P Global Platts is a provider of energy and commodities information and a source of benchmark price assessments in the physical commodity markets. The business was started with the foundation in 1909 of the magazine National Petroleum News by Warren C. Platt.

W

W"Seven Sisters" was a common term for the seven transnational oil companies of the "Consortium for Iran" oligopoly or cartel, which dominated the global petroleum industry from the mid-1940s to the mid-1970s. Alluding to the seven mythological Pleiades sisters fathered by the titan Atlas, the business usage was popularized in the 1950s by businessman Enrico Mattei, then-head of the Italian state oil company Eni. The industry group consisted of:Anglo-Iranian Oil Company Royal Dutch Shell Standard Oil Company of California Gulf Oil Texaco Standard Oil Company of New Jersey Standard Oil Company of New York

W

WThe State Oil Fund of the Republic of Azerbaijan (SOFAZ) is Azerbaijan's sovereign wealth fund, whereby energy-related earnings are accumulated and efficiently managed for future generations.

W

WIndian Strategic Petroleum Reserves Limited (ISPRL) is an Indian company responsible for maintaining the country's strategic petroleum reserves. ISPRL is a wholly owned subsidiary of the Oil Industry Development Board (OIDB), which functions under the administrative control of the Ministry of Petroleum and Natural Gas.

A stripper well or marginal well is an oil or gas well that is nearing the end of its economically useful life. In the United States a "stripper" gas well is defined by the Interstate Oil and Gas Compact Commission as one that produces 60,000 cubic feet (1,700 m3) or less of gas per day at its maximum flow rate; the Internal Revenue Service, for tax purposes, uses a threshold of 90,000 cubic feet (2,500 m3) per day. Oil wells are generally classified as stripper wells when they produce 10-15 barrels per day or less for any twelve-month period.