W

WThe Banking Act 2008 is an Act of the Parliament of the United Kingdom that entered into force on the 21 February 2008 in order to enable the UK government to nationalise high-street banks under emergency circumstances by secondary legislation. The Act was introduced in order to nationalise the failing bank Northern Rock after the bank was supported by Bank of England credit and a private-sector solution was deemed "not to provide sufficient value for the taxpayer" by the UK government.

W

WGould is a city in Lincoln County, Arkansas, United States. Its population was 837 at the 2010 census, down from 1,305 at the 2000 census. It is included in the Pine Bluff, Arkansas Metropolitan Statistical Area. Gould is a farming community. It was named after the American railroad magnate Jay Gould.

W

WVallejo is a waterfront city in Solano County, California, located in the North Bay subregion of the San Francisco Bay Area. Vallejo is geographically the closest North Bay city to the inner East Bay, so it is sometimes associated with that region. Its population was 115,942 at the 2010 census. It is the tenth most populous city in the San Francisco Bay Area, and the largest in Solano County.

W

WBeyond the Crash: Overcoming the first crisis of globalisation is a 2010 book by former UK prime minister Gordon Brown. The work argues that the only way to fully overcome the financial crisis of 2007–2010 is with further coordinated global action. Brown states that a shared "global compact" on jobs and growth should be central to effective action, with different regions called on in different ways to contribute to rebalancing the global economy while boosting growth. The book includes first-hand accounts of events leading to previous successful cases of international collaboration on economic affairs. There are specific suggestions about the different ways in which the world's nations and regions can help secure global growth, jobs and poverty reduction. A secondary theme of the work is that better global oversight is needed for the international financial system. Brown suggests that to function at their best, banks and markets need shared morals.

W

WThe 2008 Bulgarian Energy Crisis was a crisis in Bulgaria. The crisis affected more than a million households, mainly in the capital Sofia but also in Burgas, Pleven, and Vratsa. As of late September 2008, the issue was not resolved.

W

WThe 2008 Central Asia energy crisis was an energy shortage in Central Asia, which, combined with the severe weather of the 2007-08 winter and high prices for food and fuel, caused considerable hardship for many. The abnormally cold weather has pushed demand up for electricity, exacerbating the crisis. The situation was most dire in Tajikistan. An international appeal was made by the United Nations, NGOs, and the Red Cross and Red Crescent for around US$25 million to assist the government. At the time, The UN warned that millions face starvation during the 2008-09 winter.

W

WStanley Chais was an American investment advisor, money manager, and philanthropist. He operated "feeder funds" which collected money for funds related to the Madoff investment scandal. The widow, family, and estate of Chais settled with Madoff trustee Irving Picard in 2016 for $277 million.

W

WChimerica is a neologism and portmanteau coined by Niall Ferguson and Moritz Schularick describing the symbiotic relationship between China and the United States, with incidental reference to the legendary chimera. Though the term is largely in reference to economics, there is also a political element.

W

WOn April 15, 2008, Delta Air Lines and Northwest Airlines announced a merger agreement. The merger of the two carriers formed what was then the largest commercial airline in the world, with 786 aircraft. Delta Air Lines' brand survived, while Northwest's brand officially ended in 2009.

W

WFrank DiPascali, Jr. was an American financier and fraudster who was a key lieutenant of Bernie Madoff for three decades. He referred to himself as the company's "director of options trading" and as "chief financial officer". For a number of years, he played a key part in the daily operation of the Madoff investment scandal, later recounting how he helped manipulate billions of dollars in account statements so clients would believe that they were creating wealth for them. On August 11, 2009, he pleaded guilty to ten counts related to the fraud. He subsequently admitted that he had known for at least two decades that Madoff had turned his investment advisory business into a massive Ponzi scheme. He was denied bail before sentencing and spent ten months in jail before being released. He died of lung cancer in 2015 while awaiting sentencing.

W

WThe Dormant Bank and Building Society Accounts Act 2008 is an Act of the Parliament of the United Kingdom. It authorises the distribution, by the Big Lottery Fund, of assets from cash accounts that have been inactive for fifteen years.

W

WBeginning in the later half of 2008, a global-scale recession adversely affected the economy of the United States. A combination of several years of declining automobile sales and scarce availability of credit led to a more widespread crisis in the United States auto industry in the years of 2008 and 2009.

W

WThe European Communities (Finance) Act 2008 is an Act of the Parliament of the United Kingdom. It was given Royal Assent and became law on 19 February 2008.

W

WThe Finance Act 2008 is an Act of the Parliament of the United Kingdom which changes the United Kingdom's tax law as announced in the budget on 12 March 2008 by Chancellor of the Exchequer Alistair Darling. It received royal assent on 21 July 2008, and pursuant to section 1 of the Parliament Act 1911, the Act was not read a third time by the House of Lords.

W

WThe financial crisis of 2007–2008, or global financial crisis (GFC), was a severe worldwide economic crisis. It was the most serious financial crisis since the Great Depression. Predatory lending targeting low-income homebuyers, excessive risk-taking by global financial institutions, and the bursting of the United States housing bubble culminated in a "perfect storm." Mortgage-backed securities (MBS) tied to American real estate, as well as a vast web of derivatives linked to those MBS, collapsed in value. Financial institutions worldwide suffered severe damage, reaching a climax with the bankruptcy of Lehman Brothers on September 15, 2008, and a subsequent international banking crisis.

W

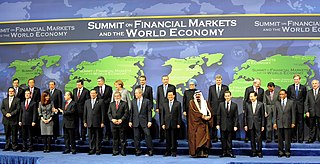

WThe 2008 G20 Washington Summit on Financial Markets and the World Economy took place on November 14–15, 2008, in Washington, D.C., United States. It achieved general agreement amongst the G20 on how to cooperate in key areas so as to strengthen economic growth, deal with the 2008 financial crisis, and lay the foundation for reform to avoid similar crises in the future. The Summit resulted from an initiative by the French and European Union President, Nicolas Sarkozy, Australian Prime Minister Kevin Rudd, and the British Prime Minister, Gordon Brown. In connection with the G7 finance ministers on October 11, 2008, United States President George W. Bush stated that the next meeting of the G20 would be important in finding solutions to the economic crisis. Since many economists and politicians called for a new Bretton Woods system to overhaul the world's financial structure, the meeting has sometimes been described by the media as Bretton Woods II.

W

WThe Icelandic financial crisis was a major economic and political event in Iceland that involved the default of all three of the country's major privately owned commercial banks in late 2008, following their difficulties in refinancing their short-term debt and a run on deposits in the Netherlands and the United Kingdom. Relative to the size of its economy, Iceland's systemic banking collapse was the largest experienced by any country in economic history. The crisis led to a severe economic slump in 2008–2010 and significant political unrest.

W

WThe Landsbanki Freezing Order 2008 is an Order of HM Treasury to freeze the assets of Icelandic bank Landsbanki in the United Kingdom made under the Anti-terrorism, Crime and Security Act 2001, by virtue of the fact that the Treasury reasonably believed that "action to the detriment of the United Kingdom's economy has been or is likely to be taken by a person or persons." As required by the enabling Act, the Order was approved by both Houses of Parliament on 28 October 2008, which was 20 days after the Order had come into force.

W

WBernard Lawrence Madoff was an American fraudster and financier who ran the largest Ponzi scheme in history, worth about $64.8 billion. He was at one time chairman of the NASDAQ stock exchange. He advanced the proliferation of electronic trading platforms and the concept of payment for order flow, which has been described as a "legal kickback".

W

WIn 2008 the Northern Rock bank was nationalised by the British government, due to financial problems caused by the subprime mortgage crisis. In 2010 the bank was split into two parts to aid the eventual sale of the bank back to the private sector.

W

WThe Predator State: How Conservatives Abandoned the Free Market and Why Liberals Should Too is a book by economist James K. Galbraith, first published in 2008. The title refers to how in US society, as Galbraith sees it, public institutions have been subverted to serve private profit: the "predators" being corporate elites. He argues that these corporate interests run the state "not for any ideological project—but simply in a way that would bring to them, individually and as a group, the most money.”

W

WReact is a book by Rosa María Artal published in Spain in 2011 by Aguilar, which compiles articles by José Luis Sampedro, Baltasar Garzón, Federico Mayor Zaragoza, Javier Pérez de Albéniz, Javier López Facal, Carlos Martínez Alonso, Ignacio Escolar, Rosa María Artal, Àngels Martínez Castells, Juan Torres Lopez and Lourdes Lucia. The book, edited by journalist Rosa María Artal, is intended to comment on the political crisis that exists in today's society -particularly in Spain- and the need for a social response to the corruption which led to the financial crisis of 2007–2008. It emphasizes the fact that the concentrations of political powers are becoming increasingly distant from the citizenship.

W

WA bank rescue package totalling some £500 billion was announced by the British government on 8 October 2008, as a response to the global financial crisis. After two unsteady weeks at the end of September, the first week of October had seen major falls in the stock market and severe worries about the stability of British banks. The plan aimed to restore market confidence and help stabilise the British banking system, and provided for a range of what was claimed to be short-term "loans" from the taxpayer and guarantees of interbank lending, including up to £50 billion of taxpayer investment in the banks themselves. The government also bought shares in some banks, which have since been sold back to the market at an overall profit to the taxpayer.

W

WThe Western Australian gas crisis was a major disruption to natural gas supply in Western Australia, caused by the rupture of a corroded pipeline and subsequent explosion at a processing plant on Varanus Island, off the state's north west coast on 3 June 2008. The plant, operated by Apache Energy, which normally supplied a third of the state's gas, was shut down for almost two months while a detailed engineering investigation and major repairs were carried out. Gas supply from the plant partially resumed in late August. By mid-October, gas production was running at two-thirds of normal capacity, with 85% of full output restored by December 2008.

W

WWorld food prices increased dramatically in 2007 and the first and second quarter of 2008, creating a global crisis and causing political and economic instability and social unrest in both poor and developed nations. Although the media spotlight focused on the riots that ensued in the face of high prices, the ongoing crisis of food insecurity had been years in the making. Systemic causes for the worldwide increases in food prices continue to be the subject of debate. After peaking in the second quarter of 2008, prices fell dramatically during the late-2000s recession but increased during late 2009 and 2010, reaching new heights in 2011 and 2012 at a level slightly higher than the level reached in 2008. Over the next years, prices fell, reaching a low in March 2016 with the deflated Food and Agriculture Organization (FAO) food price index close to pre-crisis level of 2006.