W

WThe economy of the Republic of Ireland is a highly developed knowledge economy, focused on services in high-tech, life sciences, financial services and agribusiness, including agrifood. Ireland is an open economy and ranks first for high-value foreign direct investment (FDI) flows. In the global GDP per capita tables, Ireland ranks 4th of 186 in the IMF table and 4th of 187 in the World Bank ranking.

W

WIreland's Corporate Tax System is a central component of Ireland's economy. In 2016–17, foreign firms paid 80% of Irish corporate tax, employed 25% of the Irish labour force, and created 57% of Irish OECD non-farm value-add. As of 2017, 25 of the top 50 Irish firms were U.S.–controlled businesses, representing 70% of the revenue of the top 50 Irish firms. By 2018, Ireland had received the most U.S. § Corporate tax inversions in history, and Apple was over one–fifth of Irish GDP. Academics rank Ireland as the largest tax haven; larger than the Caribbean tax haven system.

W

WThe Department of Enterprise, Trade and Employment is a department of the Government of Ireland. It is led by the Minister for Enterprise, Trade and Employment who is assisted by two Ministers of State.

W

WThe Department of Finance is a department of the Government of Ireland. It is led by the Minister for Finance and is assisted by two Minister of State.

W

WThe Department of Public Expenditure and Reform is a department of the Government of Ireland. It is led by the Minister for Public Expenditure and Reform who is assisted by two Ministers of State.

W

WThe Economic and Social Research Institute is an Irish research institute founded in 1960 to provide evidence-based research used to inform public policy debate and decision-making. The research of the institute focuses on the areas of sustainable economic growth and social progress. Alan Barrett is the Director of the institute.

W

WThe COVID-19 pandemic has had a deep impact on the Irish economy, leading it into a recession. Essential public health measures announced by the Irish Government to contain the spread of COVID-19 resulted in the largest monthly increase in unemployment in the history of the Republic of Ireland during March 2020. By 24 April, there were more than one million people in receipt of support interventions to the labour market, including those in receipt of the COVID-19 Pandemic Unemployment Payment and the COVID-19 Temporary Wage Subsidy Scheme. While there were job losses in all sectors, individuals working in tourism, hospitality, food and retail have seen the largest job losses.

W

WThe second largest city in Ireland, Cork, has an economy focused on the city centre, which as of 2011, supported employment for 24,092 people. According to 2006 figures, the top five employers in the area were public sector organisations, and included Cork University Hospital, University College Cork, Collins Barracks, Cork City Council and Cork Institute of Technology. Apple Inc. was the sixth largest employer, followed by Supervalu / Centra Distribution Ltd, Mercy University Hospital, Bon Secours Hospital and Boston Scientific.

W

WDublin is the largest city and capital of Ireland, and is the country's economic hub. As well as being the location of the national parliament and most of the civil service, Dublin is also the focal point of media in the country. Much of Ireland's transportation network radiates from the city, and Dublin Port is responsible for a large proportion of Ireland's import and export trade.

W

WOn 29 August 2016, after a two-year investigation, Margrethe Vestager of the European Commission announced: "Ireland granted illegal tax benefits to Apple". The Commission ordered Apple to pay €13 billion, plus interest, in unpaid Irish taxes from 2004–14 to the Irish state. It was the largest corporate tax "fine" in history. On 7 September 2016, the Irish State secured a majority in Dáil Éireann to reject payment of the back-taxes, which including penalties could reach €20 billion, or 10% of 2014 Irish GDP. In November 2016, the Irish government formally appealed the ruling, claiming there was no violation of Irish tax law, and that the commission's action was "an intrusion into Irish sovereignty", as national tax policy is excluded from EU treaties. In November 2016, Apple CEO Tim Cook, announced Apple would appeal, and in September 2018, Apple lodged €13 billion to an escrow account, pending appeal. In July 2020, the European General Court struck down EU tax decision as illegal, ruling in favor of Apple.

W

WThe Minister for Enterprise, Trade and Employment is the senior minister at the Department of Enterprise, Trade and Employment in the Government of Ireland.

W

WIrish euro coins all share the same design by Jarlath Hayes, that of the harp, a traditional symbol for Ireland since the Middle Ages, based on that of the Brian Boru harp, housed in Trinity College, Dublin. The same harp is used as on the official seals of the Taoiseach, and government ministers and the Seal of the President of Ireland. The coins' design also features the 12 stars of the EU, the year of issue and the Irish name for Ireland, "Éire", in a traditional Gaelic script.

W

WThe Minister for Finance is the senior minister at the Department of Finance in the Government of Ireland. The minister is responsible for all financial and monetary matters of the state, and is considered the second most important member of the Government of Ireland, after the Taoiseach.

W

WDr Constantin Gurdgiev is a Russian economist and professor based in Dublin, Ireland. He is a former editor of Business & Finance Magazine. Gurdgiev is well known in Ireland from his frequent appearances on the Tonight with Vincent Browne television show on TV3 during the great recession. Gurdgiev identifies as a libertarian.

W

WThe Ideas Campaign is a grassroots initiative in the Republic of Ireland asking ordinary people for ideas to stimulate economic activity.

W

WThe International Financial Services Centre (IFSC) is an area of central Dublin and part of the CBD established in the 1980s as an urban regeneration area and special economic zone (SEZ) on the derelict state owned former port authority lands of the reclaimed North Wall and George's Dock areas of the Dublin Docklands. The term has now morphed into use as a metonym for the Irish financial services industry as well as being used as an address and still being classified as an SEZ.

W

WThe Irish property bubble was the speculative excess element of a long-term price increase of real estate in the Republic of Ireland from the early 2000s to 2007, a period known as the later part of the Celtic Tiger. In 2006, the prices peaked at the top of the bubble, with a combination of increased speculative construction and rapidly rising prices; in 2007 the prices first stabilised and then started to fall until 2010 following the shock effect of the Great Recession. By the second quarter of 2010, house prices in Ireland had fallen by 35% compared with the second quarter of 2007, and the number of housing loans approved fell by 73%.

W

WAn Irish Section 110 special purpose vehicle (SPV) or section 110 company, is an Irish tax resident company, which qualifies under Section 110 of the Irish Taxes Consolidation Act 1997 (TCA) for a special tax regime that enables the SPV to attain "tax neutrality": i.e. the SPV pays no Irish taxes, VAT, or duties.

W

WLeprechaun economics was a term coined by Paul Krugman to describe the 26.3 per cent rise in Irish 2015 GDP, later revised to 34.4 per cent, in a 12 July 2016 publication by the Irish Central Statistics Office (CSO), restating 2015 Irish national accounts. At that point, the historical distortion of Irish economic data by tax-driven accounting flows reached a climax; by 2020, Krugman said the term was a feature of all tax havens.

W

WMatheson, is an Irish law firm partnership based in the IFSC in Dublin, which specialises in multinational tax schemes, and tax structuring of special purpose vehicles. Matheson is estimated to be Ireland's largest corporate law firm. Matheson state in the International Tax Review that their tax department is: "significantly the largest tax practice group amongst Irish law firms".

W

WMetrication in the Republic of Ireland happened mostly in the 20th century and was officially completed in 2005, with a few exceptions.

W

WMidlands Gateway also known as Lake-Counties Gateway is area centered between the major Irish airports, of Dublin, Shannon, and Knock, with ever-improving ground infrastructure, the Irish government and local authorities plan to alleviate urban problems, by decentralising to growing gateways such as the Midlands Gateway of Offaly and Westmeath. According to the Irish National Development plan the Midlands gateway objectives are to reinforce and further develop strong links between these towns and the neighbouring urban centres, by means of infrastructure and services in order to maximise internal and external accessibility as a location for investment business development and tourism.

W

WThe Minister for Supplies was created by the Ministers and Secretaries (Amendment) Act 1939, to assist Ireland through World War II, or the Emergency, as it was referred to by the Government of Ireland. Although the legislation creating the new department was not passed until 21 December 1939, it was given retrospective effect, and was deemed to have come into force on 8 September 1939.

W

WModified gross national income, Modified GNI or GNI* was created by the Central Bank of Ireland in February 2017 as a new way to measure the Irish economy, and Irish indebtedness, due to the increasing distortion that the base erosion and profit shifting ("BEPS") tools of US multinational tax schemes were having on Irish GNP and Irish GDP; the climax being the July 2016 leprechaun economics affair with Apple Inc.

W

WThe National Competitiveness Council is an independent policy advisory body in Ireland. It reports to the Taoiseach on key competitiveness issues facing the Irish economy together with recommendations on policy actions required to enhance Ireland's competitive position. It was established by the Irish Government in May 1997 as part of the Partnership 2000 Social Partnership agreement. The Strategic Policy Division of the Department of Enterprise, Trade and Employment provides the Council with research and secretariat support.

W

WNational Development Plan was the title given by the Irish Government to a scheme of organised large-scale expenditure on (mainly) national infrastructure. The first five-year plan ran from 1988 to 1993, the second was a six-year plan from 1994 to 1999 and the third ran as a seven-year plan from 2000 to 2006. A fourth National Development Plan ran from 2007 to 2011. The main elements of the third plan were the development of a national motorway network between the major cities in Ireland. The upgrading of the rail network was a secondary scheme.

W

WThe National Lottery is the state lottery of Republic of Ireland. It was created when the Republic of Ireland government passed the National Lottery Act, 1986 to help raise funds for good causes. The eligible causes are sport and recreation, health and welfare, national heritage and the arts, the Irish language, and the natural environment.

W

WThe Personal Public Service Number is an identifier issued by the Client Identity Services section of the Department of Social Protection, on behalf of the Minister for Social Protection in Ireland.

W

W'Put on the green jersey' is a phrase to represent putting the Irish national interest first. The phrase can be used in a positive sense, for example evoking feelings of national unity during times of crisis. The phrase can also be used in a negative sense - e.g. the Irish national interest as an excuse for immoral conduct or corruption. The phrase originates due to Ireland's sporting teams all wearing green - such as the Republic of Ireland national football team.

W

WQualifying Investor Alternative Investment Fund or QIAIF is a Central Bank of Ireland regulatory classification established in 2013 for Ireland's five tax-free legal structures for holding assets. The Irish Collective Asset-management Vehicle or ICAV is the most popular of the five Irish QIAIF structures, and was designed in 2014 to rival the Cayman Island SPC; it is the main tax-free structure for foreign investors holding Irish assets.

W

WSandyford is a suburb of Dublin, located in Dún Laoghaire–Rathdown, Ireland.

W

WScience Foundation Ireland (SFI) is the statutory body in the Republic of Ireland with responsibility for funding oriented basic and applied research in the areas of science, technology, engineering and mathematics (STEM) with a strategic focus. The agency was established in 2003 under the Industrial Development Act 2003 and is run by a board appointed by the Minister for Further and Higher Education, Research, Innovation and Science. SFI is an agency of the Department of Further and Higher Education, Research, Innovation and Science.

W

WShannon Development was an important regional development body for the Shannon Region of Ireland. Its area in the lower River Shannon basin comprised all of counties Clare, Limerick, and the former North Tipperary, as well as north Kerry and west Offaly. Its key founder was Brendan O'Regan.

W

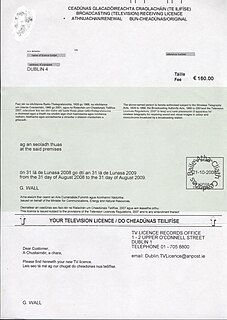

WIn Ireland, a television licence is required for any address at which there is a television set. Since 2016, the annual licence fee is €160. Revenue is collected by An Post, the Irish postal service. The bulk of the fee is used to fund Raidió Teilifís Éireann (RTÉ), the state broadcaster. The licence must be paid for any premises that has any equipment that can potentially decode TV signals, even those that are not RTÉ's. The licence is free to anyone over the age of 70, some over 66, some Social Welfare recipients, and the blind. The fee for the licences of such beneficiaries is paid for by the state. The current governing legislation is the Broadcasting Act 2009, in particular Part 9 "Television Licence" and Chapter 5 "Allocation of Public Funding to RTÉ and TG4". Devices which stream television via internet do not need licences, nor do small portable devices such as mobile phones.

W

WÚdarás na Gaeltachta, abbreviated UnaG, is a regional state agency which is responsible for the economic, social and cultural development of Irish-speaking (Gaeltacht) regions of Ireland. Its stated purpose is to strengthen the Gaeltacht communities, to increase the quality of life of its community members and facilitate the preservation and extension of the Irish language as the principal language of the region. It gives funding to small local businesses that have to compete with foreign companies.