W

WActuarial science is the discipline that applies mathematical and statistical methods to assess risk in insurance, finance, and other industries and professions. More generally, actuaries apply rigorous mathematics to model matters of uncertainty.

W

WA 100-year flood is a flood event that has a 1 in 100 chance of being equaled or exceeded in any given year.

W

WActuarial notation is a shorthand method to allow actuaries to record mathematical formulas that deal with interest rates and life tables.

W

WAn actuary is a business professional who deals with the measurement and management of risk and uncertainty. The name of the corresponding field is actuarial science. These risks can affect both sides of the balance sheet and require asset management, liability management, and valuation skills. Actuaries provide assessments of financial security systems, with a focus on their complexity, their mathematics, and their mechanisms.

W

WAsset allocation is the implementation of an investment strategy that attempts to balance risk versus reward by adjusting the percentage of each asset in an investment portfolio according to the investor's risk tolerance, goals and investment time frame. The focus is on the characteristics of the overall portfolio. Such a strategy contrasts with an approach that focuses on individual assets.

W

WIn statistics, marketing and demography, a cohort is a group of subjects who share a defining characteristic.

W

WCompound interest is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest. It is the result of reinvesting interest, rather than paying it out, so that interest in the next period is then earned on the principal sum plus previously accumulated interest. Compound interest is standard in finance and economics.

W

WComputational finance is a branch of applied computer science that deals with problems of practical interest in finance. Some slightly different definitions are the study of data and algorithms currently used in finance and the mathematics of computer programs that realize financial models or systems.

W

WCRESTA was founded as a joint project of Swiss Reinsurance Company, Gerling-Konzern Globale Reinsurance Company, and Munich Reinsurance Company. CRESTA has set itself the aim of establishing a globally uniform system for the accumulation risk control of natural hazards - particularly earthquakes, storms and floods. Those risk zones are essentially based on the observed and expected seismic activity, as well as on other natural disasters, such as droughts, floods and storms. CRESTA zones regard the distribution of insured values within a region or country for easier assessment of risks. CRESTA Zones are the essential basis for reinsurance negotiation and portfolio analysis. Nowadays, CRESTA sets widely accepted standards which apply throughout the international insurance industry. CRESTA zone information is used by most insurers for assessing the insurance catastrophe premiums they will charge.

W

WDemography is the statistical study of populations, especially human beings.

W

WDiscounting is a financial mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee. Essentially, the party that owes money in the present purchases the right to delay the payment until some future date. This transaction is based on the fact that most people prefer current interest to delayed interest because of mortality effects, impatience effects, and salience effects. The discount, or charge, is the difference between the original amount owed in the present and the amount that has to be paid in the future to settle the debt.

W

WA disease is a particular abnormal condition that negatively affects the structure or function of all or part of an organism, and that is not due to any immediate external injury. Diseases are often known to be medical conditions that are associated with specific signs and symptoms. A disease may be caused by external factors such as pathogens or by internal dysfunctions. For example, internal dysfunctions of the immune system can produce a variety of different diseases, including various forms of immunodeficiency, hypersensitivity, allergies and autoimmune disorders.

W

WExtreme value theory or extreme value analysis (EVA) is a branch of statistics dealing with the extreme deviations from the median of probability distributions. It seeks to assess, from a given ordered sample of a given random variable, the probability of events that are more extreme than any previously observed. Extreme value analysis is widely used in many disciplines, such as structural engineering, finance, earth sciences, traffic prediction, and geological engineering. For example, EVA might be used in the field of hydrology to estimate the probability of an unusually large flooding event, such as the 100-year flood. Similarly, for the design of a breakwater, a coastal engineer would seek to estimate the 50-year wave and design the structure accordingly.

W

WGeneral insurance or non-life insurance policies, including automobile and homeowners policies, provide payments depending on the loss from a particular financial event. General insurance is typically defined as any insurance that is not determined to be life insurance. It is called property and casualty insurance in the United States and Canada and non-life insurance in Continental Europe.

W

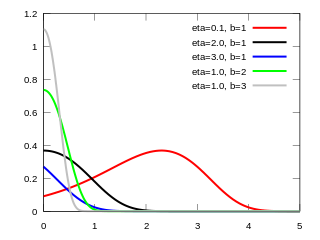

WIn probability and statistics, the Gompertz distribution is a continuous probability distribution, named after Benjamin Gompertz. The Gompertz distribution is often applied to describe the distribution of adult lifespans by demographers and actuaries. Related fields of science such as biology and gerontology also considered the Gompertz distribution for the analysis of survival. More recently, computer scientists have also started to model the failure rates of computer code by the Gompertz distribution. In Marketing Science, it has been used as an individual-level simulation for customer lifetime value modeling. In network theory, particularly the Erdős–Rényi model, the walk length of a random self-avoiding walk (SAW) is distributed according to the Gompertz distribution.

W

WThe Gompertz–Makeham law states that the human death rate is the sum of an age-dependent component, which increases exponentially with age and an age-independent component. In a protected environment where external causes of death are rare, the age-independent mortality component is often negligible. In this case the formula simplifies to a Gompertz law of mortality. In 1825, Benjamin Gompertz proposed an exponential increase in death rates with age.

W

WJohn Graunt has been regarded as the founder of demography. Graunt was one of the first demographers, and perhaps the first epidemiologist, though by profession he was a haberdasher. He was bankrupted later in life by losses suffered during Great Fire of London and the discrimination he faced following his conversion to Catholicism.

W

WIFRS 4 is an International Financial Reporting Standard (IFRS) issued by the International Accounting Standards Board (IASB) providing guidance for the accounting of insurance contracts. The standard was issued in March 2004, and was amended in 2005 to clarify that the standard covers most financial guarantee contracts. Paragraph 35 of IFRS also applies the standard to financial instruments with discretionary participation features.

W

WIFRS 17 is an International Financial Reporting Standard that was issued by the International Accounting Standards Board in May 2017. It will replace IFRS 4 on accounting for insurance contracts and has an effective date of 1 January 2023. In November 2018 the International Accounting Standards Board proposed to delay the effective date by one year to 1 January 2022. In March 2020, the International Accounting Standards Board decided a further deferral of the effective date to 1 January 2023.

W

WIn statistics, an influential observation is an observation for a statistical calculation whose deletion from the dataset would noticeably change the result of the calculation. In particular, in regression analysis an influential observation is one whose deletion has a large effect on the parameter estimates.

W

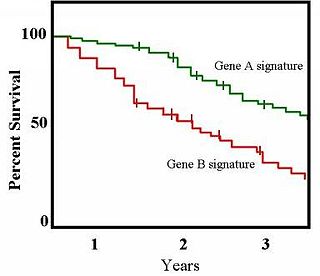

WThe Kaplan–Meier estimator, also known as the product limit estimator, is a non-parametric statistic used to estimate the survival function from lifetime data. In medical research, it is often used to measure the fraction of patients living for a certain amount of time after treatment. In other fields, Kaplan–Meier estimators may be used to measure the length of time people remain unemployed after a job loss, the time-to-failure of machine parts, or how long fleshy fruits remain on plants before they are removed by frugivores. The estimator is named after Edward L. Kaplan and Paul Meier, who each submitted similar manuscripts to the Journal of the American Statistical Association. The journal editor, John Tukey, convinced them to combine their work into one paper, which has been cited more than 59,000 times since its publication in 1958.

W

WIn gerontology, late-life mortality deceleration is the disputed theory that hazard rate increases at a decreasing rate in late life rather than increasing exponentially as in the Gompertz law.

W

WIn gerontology, late-life mortality deceleration is the disputed theory that hazard rate increases at a decreasing rate in late life rather than increasing exponentially as in the Gompertz law.

W

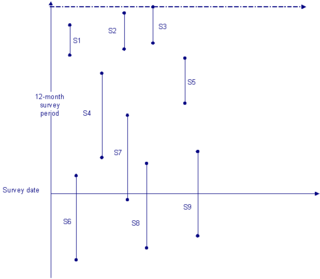

WIn demography, the field of study that deals with the study of populations), a Lexis diagram is a two dimensional diagram used to represent events that occur to individuals belonging to different cohorts. Calendar time is usually represented on the horizontal axis, while age is represented on the vertical axis. In some cases, the y-axis is plotted backwards, with age 0 at the top of the page and increasing downwards. Other arrangements of the axes are also seen. As an example the death of an individual in 2009 at age 80 is represented by the point (2009,80); the cohort of all persons born in 1929 is represented by a diagonal line starting at (1929,0) and continuing through (1930,1)., and so on.

W

WLife expectancy is a statistical measure of the average time an organism is expected to live, based on the year of its birth, its current age, and other demographic factors including sex. The most commonly used measure is life expectancy at birth (LEB), which can be defined in two ways. Cohort LEB is the mean length of life of an actual birth cohort and can be computed only for cohorts born many decades ago so that all their members have died. Period LEB is the mean length of life of a hypothetical cohort assumed to be exposed, from birth through death, to the mortality rates observed at a given year.

W

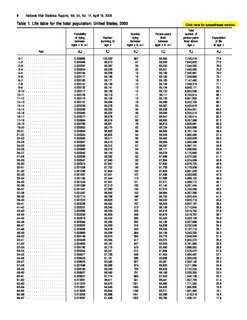

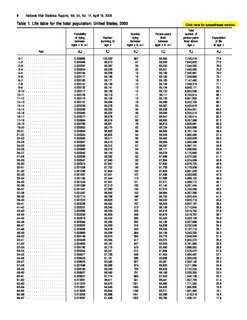

WIn actuarial science and demography, a life table is a table which shows, for each age, what the probability is that a person of that age will die before their next birthday. In other words, it represents the survivorship of people from a certain population. They can also be explained as a long-term mathematical way to measure a population's longevity. Tables have been created by demographers including Graunt, Reed and Merrell, Keyfitz, and Greville.

W

WMathematical statistics is the application of probability theory, a branch of mathematics, to statistics, as opposed to techniques for collecting statistical data. Specific mathematical techniques which are used for this include mathematical analysis, linear algebra, stochastic analysis, differential equations, and measure theory.

W

WMortality rate, or death rate, is a measure of the number of deaths in a particular population, scaled to the size of that population, per unit of time. Mortality rate is typically expressed in units of deaths per 1,000 individuals per year; thus, a mortality rate of 9.5 in a population of 1,000 would mean 9.5 deaths per year in that entire population, or 0.95% out of the total. It is distinct from "morbidity", which is either the prevalence or incidence of a disease, and also from the incidence rate.

W

WThe Pareto distribution, named after the Italian civil engineer, economist, and sociologist Vilfredo Pareto,, is a power-law probability distribution that is used in description of social, quality control, scientific, geophysical, actuarial, and many other types of observable phenomena. Originally applied to describing the distribution of wealth in a society, fitting the trend that a large portion of wealth is held by a small fraction of the population. The Pareto principle or "80-20 rule" stating that 80% of outcomes are due to 20% of causes was named in honour of Pareto, but the concepts are distinct, and only Pareto distributions with shape value of log45 ≈ 1.16 precisely reflect it. Empirical observation has shown that this 80-20 distribution fits a wide range of cases, including natural phenomena and human activities.

W

WIn statistical modeling, regression analysis is a set of statistical processes for estimating the relationships between a dependent variable and one or more independent variables. The most common form of regression analysis is linear regression, in which one finds the line that most closely fits the data according to a specific mathematical criterion. For example, the method of ordinary least squares computes the unique line that minimizes the sum of squared differences between the true data and that line. For specific mathematical reasons, this allows the researcher to estimate the conditional expectation of the dependent variable when the independent variables take on a given set of values. Less common forms of regression use slightly different procedures to estimate alternative location parameters or estimate the conditional expectation across a broader collection of non-linear models.

W

WReinsurance is insurance that an insurance company purchases from another insurance company to insulate itself from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own insurance liabilities to the other insurance company. The company that purchases the reinsurance policy is called a "ceding company" or "cedent" or "cedant" under most arrangements. The company issuing the reinsurance policy is referred to as the "reinsurer". In the classic case, reinsurance allows insurance companies to remain solvent after major claims events, such as major disasters like hurricanes and wildfires. In addition to its basic role in risk management, reinsurance is sometimes used to reduce the ceding company's capital requirements, or for tax mitigation or other purposes.

W

WAt retirement, individuals stop working and no longer get employment earnings, and enter a phase of their lives, where they rely on the assets they have accumulated, to supply money for their spending needs for the rest of their lives. Retirement spend-down, or withdrawal rate, is the strategy a retiree follows to spend, decumulate or withdraw assets during retirement.

W

WIn economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome. Risk aversion explains the inclination to agree to a situation with a more predictable, but possibly lower payoff, rather than another situation with a highly unpredictable, but possibly higher payoff. For example, a risk-averse investor might choose to put their money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value.

W

WRisk inclination (RI) is defined as a mental disposition toward an eventuality that has consequences. The risk inclination model (RIM) is composed of three constructs: confidence weighting, restricted context, and the risk inclination formula. Each of these constructs connects an outside observer with a respondent’s inner state of risk taking toward knowledge certainty.

W

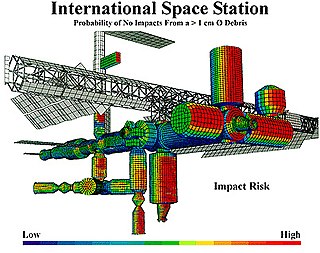

WRisk management is the identification, evaluation, and prioritization of risks followed by coordinated and economical application of resources to minimize, monitor, and control the probability or impact of unfortunate events or to maximize the realization of opportunities.

W

WStock sampling is sampling people in a certain state at the time of the survey. This is in contrast to flow sampling, where the relationship of interest deals with duration or survival analysis. In stock sampling, rather than focusing on transitions within a certain time interval, we only have observations at a certain point in time. This can lead to both left and right censoring. Imposing the same model on data that have been generated under the two different sampling regimes can lead to research reaching fundamentally different conclusions if the joint distribution across the flow and stock samples differ sufficiently.

W

WThe time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later. It may be seen as an implication of the later-developed concept of time preference.

W

WValue at risk (VaR) is a measure of the risk of loss for investments. It estimates how much a set of investments might lose, given normal market conditions, in a set time period such as a day. VaR is typically used by firms and regulators in the financial industry to gauge the amount of assets needed to cover possible losses.

W

WThe Vienna Institute of Demography (VID) is a research institute of the division for humanities and social sciences within the Austrian Academy of Sciences (ÖAW) and part of the three "pillar institutions" of the Wittgenstein Centre for Demography and Global Human Capital.

W

WWorkers' compensation or workers' comp is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue his or her employer for the tort of negligence. The trade-off between assured, limited coverage and lack of recourse outside the worker compensation system is known as "the compensation bargain". One of the problems that the compensation bargain solved is the problem of employers becoming insolvent as a result of high damage awards. The system of collective liability was created to prevent that, and thus to ensure security of compensation to the workers.