W

WThe 2008 Liechtenstein tax affair is a series of tax investigations in numerous countries whose governments suspect that some of their citizens may have evaded tax obligations by using banks and trusts in Liechtenstein; the affair broke open with the biggest complex of investigations ever initiated for tax evasion in the Federal Republic of Germany. It is seen also as an attempt to put pressure on Liechtenstein, one of the remaining uncooperative tax havens, as identified by the Financial Action Task Force (FATF) on Money Laundering of the Paris-based Organisation for Economic Co-operation and Development, along with Andorra and Monaco, in 2007.

W

WA referendum on banning politicians and civil servants from having bank accounts or companies based in tax havens was held in Ecuador on 19 February 2017, alongside general elections. The proposal was approved by voters, giving officials one year to transfer their assets or be removed from their posts.

W

WThe Authority of the Freeport Area of Bataan (AFAB) is a government agency attached to the Office of the President of the Philippines that operates and manages the Freeport Area of Bataan (FAB) in Mariveles, Bataan, Philippines.

W

WIn trade, barter is a system of exchange in which participants in a transaction directly exchange goods or services for other goods or services without using a medium of exchange, such as money. Economists distinguish barter from gift economies in many ways; barter, for example, features immediate reciprocal exchange, not one delayed in time. Barter usually takes place on a bilateral basis, but may be multilateral. In most developed countries, barter usually exists parallel to monetary systems only to a very limited extent. Market actors use barter as a replacement for money as the method of exchange in times of monetary crisis, such as when currency becomes unstable or simply unavailable for conducting commerce.

W

WBase erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions, thus "eroding" the "tax-base" of the higher-tax jurisdictions. The Organisation for Economic Co-operation and Development (OECD) define BEPS strategies as "exploiting gaps and mismatches in tax rules".

W

WBermuda black hole was an historical term given to the final destination for untaxed global profits of corporate base erosion and profit shifting (BEPS) tax avoidance schemes which ended up in Bermuda, which is considered a tax haven. The term was most associated with US technology multinationals such as Apple and Google who used Bermuda as the "terminus" for their Double Irish arrangement tax structure.

W

WBø is a municipality in Nordland county, Norway. It is part of the Vesterålen region. The administrative centre of the municipality is the village of Straume. Other villages in the municipality include Auvåg, the village of Bø, Eidet, Guvåg, Hovden, Klakksjorda, Malnes, Nykvåg, Utskor, and Vågen. The Litløy Lighthouse is located on the tiny island of Litløya off the coast of Bø.

W

WIn British slang, a booze cruise is a brief trip from Britain to France or Belgium with the intent of taking advantage of lower prices, and buying personal supplies of (especially) alcohol or tobacco in bulk quantities. This is a legally acceptable process and should not be confused with smuggling.

W

WA brass plate company or brass plate trust is a legally constituted company lacking meaningful connection with the location of incorporation. The name is based on a company whose only tangible existence in its jurisdiction of incorporation is the nameplate attached to the wall outside its registered office. The registered office is often the same office and address of the local professional service firm(s) or corporate service provider(s) (CSPs), who act as local support to the company. Brass plate structures are associated with tax havens, corporate tax havens, and offshore financial centres.

W

WCanada v GlaxoSmithKline Inc is the first ruling of the Supreme Court of Canada that deals with issues involving transfer pricing and how they are treated under the Income Tax Act of Canada ("ITA").

W

WThe Cayman Islands is a self-governing British Overseas Territory, the largest by population, in the western Caribbean Sea. The 264-square-kilometre (102-square-mile) territory comprises the three islands of Grand Cayman, Cayman Brac and Little Cayman, which are located to the south of Cuba and northeast of Honduras, between Jamaica and Mexico's Yucatán Peninsula. The capital city is George Town on Grand Cayman, which is the most populous of the three islands.

W

WThe Economic and Financial Affairs Council (ECOFIN) is one of the oldest configurations of the Council of the European Union and is composed of the economics and finance ministers of the 27 European Union member states, as well as Budget Ministers when budgetary issues are discussed.

W

WConduit OFC and sink OFC is an empirical quantitative method of classifying corporate tax havens, offshore financial centres (OFCs) and tax havens.

W

WThe Corporation Trust Center, 1209 North Orange Street, is a single-story building located in the Brandywine neighborhood of Wilmington, Delaware, United States, operated by CT Corporation, a subsidiary of Dutch multinational services firm Wolters Kluwer. This is CT Corporation's location in the state of Delaware for providing "registered agent services." In 2012, it was the registered agent address of at least 285,000 separate American and foreign businesses who operate or trade in the United States.

W

WA disposable ship, also called raft ship, timber ship, or timber drogher was a barely seaworthy vessel assembled from large timbers lashed or pegged together for the purpose of making just a single voyage from North America to England, where the vessel was subsequently dismantled and its timbers sold piecemeal to British shipbuilders. The disposable ship avoided two problems that adversely impacted profitability of shipping in the British timber trade: high taxes and small cargoes.

W

WDutch Sandwich is a base erosion and profit shifting (BEPS) corporate tax tool, used mostly by U.S. multinationals to avoid incurring EU withholding taxes on untaxed profits as they were being moved to non-EU tax havens. These untaxed profits could have originated from within the EU, or from outside the EU, but in most cases were routed to major EU corporate-focused tax havens, such as Ireland and Luxembourg, by the use of other BEPS tools. The Dutch Sandwich was often used with Irish BEPS tools such as the Double Irish, the Single Malt and the Capital Allowances for Intangible Assets ("CAIA") tools. In 2010, Ireland changed its tax-code to enable Irish BEPS tools to avoid such withholding taxes without needing a Dutch Sandwich.

W

WA duty-free shop is a retail outlet whose goods are exempt from the payment of certain local or national taxes and duties, on the requirement that the goods sold will be sold to travelers who will take them out of the country. Which products can be sold duty-free vary by jurisdiction, as well as how they can be sold, and the process of calculating the duty or refunding the duty component.

W

WEstate planning is the process of anticipating and arranging, during a person's life, for the management and disposal of that person's estate during the person's life, in the event the person becomes incapacitated and after death. The planning includes the bequest of assets to heirs and may include minimizing gift, estate, generation skipping transfer, and taxes. Estate planning includes planning for incapacity as well as a process of reducing or eliminating uncertainties over the administration of a probate and maximizing the value of the estate by reducing taxes and other expenses. The ultimate goal of estate planning can only be determined by the specific goals of the estate owner and may be as simple or complex as the owner's wishes and needs directs. Guardians are often designated for minor children and beneficiaries in incapacity.

W

WA family office is a privately held company that handles investment management and wealth management for a wealthy family, generally one with over $100 million in investable assets, with the goal being to effectively grow and transfer wealth across generations. The company's financial capital is the family's own wealth. Family offices also may handle tasks such as managing household staff, making travel arrangements, property management, day-to-day accounting and payroll activities, management of legal affairs, family management services, family governance, financial and investor education, coordination of philanthropy and private foundations, and succession planning. A family office can cost over $1 million a year to operate, so the family's net worth usually exceeds $100 million in investable assets. Some family offices accept investments from people who are not members of the owning family. It came to light during the 2021 implosion of Archegos Capital Management that family offices were reportedly "more loosely regulated than other investment vehicles, with fewer disclosure requirements." In response to these concerns, Rep. Alexandria Ocasio-Cortez, D-NY, introduced The Family Office Regulation Act of 2021, H.R. 4620, which would limit the use of the family office exemption from registration as an investment advisor with the SEC to offices with $750 million or less in assets under management. The bill would also prevent persons who are barred or subject to final orders for conduct constituting fraud, manipulation or deceit from being associated with a family office. This view, however, is not shared by a number of regulators and commentators, including Commissioner Hester Peirce of the Securities and Exchange Commission (SEC) and Commissioner Brian Quintenz of the Commodity Futures Trading Commission (CFTC), who published an Op Ed arguing that family offices do not need new regulations.

W

WThe Financial Secrecy Index (FSI) is a report published by the advocacy organization Tax Justice Network which ranks countries by financial secrecy indicators, weighted by the economic flows of each country.

W

WFurniss v. Dawson is an important House of Lords case in the field of UK tax. Its full name is Furniss v. Dawson D.E.R., Furniss v. Dawson G.E., Murdoch v. Dawson R.S., and its citation is [1984] A.C. 474, or alternatively [1984] 2 W.L.R. 226.

W

WGeneva Freeport is a warehouse complex in Geneva, Switzerland, for the storage of art and other valuables and collectibles. It is the oldest and largest freeport facility, and the one with the most artworks, with 40% of its collection being art and an estimated art collection value of US$100 billion.

W

WHeligoland is a small archipelago in the North Sea. A part of the German state of Schleswig-Holstein since 1890, the islands were historically possessions of Denmark, then became the possessions of the United Kingdom from 1807 to 1890, and briefly managed as a war prize from 1945 to 1952.

W

WThe Hidden Wealth of Nations: The Scourge of Tax Havens is a 2013 book by French economist Gabriel Zucman, which popularized the concept of both the tax haven and corporate tax haven. The French publication was translated into English by Teresa Lavender Fagan. The foreword was written by Thomas Piketty, Zucman's PhD supervisor. Both Piketty and Zucman are critical of capitalism in its present form. Where Piketty's best-selling Capital in the Twenty-First Century was the catalyst for debate about inequality, Zucman targets individual and corporate tax havens. According to Zucman's research, $USD7.6 trillion representing about eight percent of global net financial wealth, is held in offshore accounts where no taxes are collected.

W

WThe Institute on Taxation and Economic Policy (ITEP) is a non-profit, non-partisan think tank that works on state and federal tax policy issues. ITEP was founded in 1980, and is a 501(c)(3) tax-exempt organization. ITEP describes its mission as striving to “keep policymakers and the public informed of the effects of current and proposed tax policies on tax fairness, government budgets and sound economic policy.”

W

WThe Inter-American Center of Tax Administrations "CIAT" is an international organization specialized in training and exchanges of information between national tax administrations.

W

WAn Irish Section 110 special purpose vehicle (SPV) or section 110 company, is an Irish tax resident company, which qualifies under Section 110 of the Irish Taxes Consolidation Act 1997 (TCA) for a special tax regime that enables the SPV to attain "tax neutrality": i.e. the SPV pays no Irish taxes, VAT, or duties.

W

WLiechtenstein, officially the Principality of Liechtenstein, is a German-speaking microstate situated in the Alps between Austria and Switzerland in Central Europe. The principality is a semi-constitutional monarchy headed by the Prince of Liechtenstein; the Prince's extensive powers are equivalent to those of a President in a semi-presidential system.

W

WLuxembourg Leaks is the name of a financial scandal revealed in November 2014 by a journalistic investigation conducted by the International Consortium of Investigative Journalists. It is based on confidential information about Luxembourg's tax rulings set up by PricewaterhouseCoopers from 2002 to 2010 to the benefits of its clients. This investigation resulted in making available to the public tax rulings for over three hundred multinational companies based in Luxembourg.

W

WMaples Group is a multi-jurisdictional law firm headquartered in the Cayman Islands, with offices in traditional tax havens and corporate tax havens. It is a member of the offshore magic circle. The firm specialises in advising on the laws of the Cayman Islands, Ireland and the British Virgin Islands, across a range of legal services including commercial litigation, intellectual property, sport, and finance, in which the firm has a focus on the structuring of tax efficient legal structures, and executing base erosion and profit shifting (BEPS) transactions for corporations.

W

WMatheson, is an Irish law firm partnership based in the IFSC in Dublin, which specialises in multinational tax schemes, and tax structuring of special purpose vehicles. Matheson is estimated to be Ireland's largest corporate law firm. Matheson state in the International Tax Review that their tax department is: "significantly the largest tax practice group amongst Irish law firms".

W

WMullens v Federal Commissioner of Taxation, was a 1976 High Court of Australia tax case concerning arrangements where stockbrokers Mullens & Co accessed tax deductions for monies subscribed to a petroleum exploration company. The Australian Taxation Office held the scheme was tax avoidance, but the court found for the taxpayer.

W

WAn offshore financial centre or OFC is defined as a "country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy."

W

WOffshore Leaks is a report disclosing details of 130,000 offshore accounts in April 2013. Some observers have called it the biggest hit against international tax fraud of all times, although it has been pointed out that normal businesses may use the offshore legislation to ease formalities in international trade.

W

WA number of top executives in large businesses and governments have worked for a one-dollar salary. One-dollar salaries are used in situations where an executive wishes to work without direct compensation, but for legal reasons must receive a payment above zero, so as to distinguish them from a volunteer. The concept first emerged in the early 1900s, where various leaders of industry in the United States offered their services to the government during times of war. Later, in the late 1990s and early 2000s, many business executives began accepting one-dollar salaries—often in the case of struggling companies or startups—with the potential for further indirect earnings as the result of their ownership of stock.

W

WFeargal O'Rourke is an Irish accountant and corporate tax expert, who is the managing partner of PwC in Ireland. He is considered the architect of the famous Double Irish tax scheme used by U.S. firms such as Apple, Google and Facebook in Ireland, and a leader in the development of corporate tax planning tools, and tax legislation, for U.S. multinationals in Ireland.

W

WThe Panama Papers are 11.5 million leaked documents that were published beginning on April 3, 2016. The papers detail financial and attorney–client information for more than 214,488 offshore entities. The documents, some dating back to the 1970s, were created by, and taken from, former Panamanian law firm and corporate service provider Mossack Fonseca.

W

WThe term "perpetual traveler" refers to the idea that by basing different aspects of one's life in different countries and not spending too long in any one place, a person can reduce taxes, avoid civic duties, and increase personal freedom. Books and services relating to the PT idea have been a staple of companies that specialise in marketing offshore financial services, tax avoidance schemes, and personal privacy services.

W

WUnder Ministerial Order n. 150/2004 of 13 February, issued by the Portuguese Ministry of Finance and consequently updated, Portugal defines an official blacklist of countries and jurisdictions considered for legal and tax purposes as tax havens.

W

WQualifying Investor Alternative Investment Fund or QIAIF is a Central Bank of Ireland regulatory classification established in 2013 for Ireland's five tax-free legal structures for holding assets. The Irish Collective Asset-management Vehicle or ICAV is the most popular of the five Irish QIAIF structures, and was designed in 2014 to rival the Cayman Island SPC; it is the main tax-free structure for foreign investors holding Irish assets.

W

WSalary packaging is the inclusion of employee benefits in an employee remuneration package in exchange for giving up part of monetary salary. Such arrangements are entered into most commonly if there are tax or other benefits to be derived by the employer or employee from the arrangement.

W

WSamnaun is a high Alpine village and a valley at the eastern end of Switzerland and a municipality in the Engiadina Bassa/Val Müstair Region in the Swiss canton of Graubünden.

W

WA shell corporation is a company or corporation that exists only on paper and has no office and no employees, but may have a bank account or may hold passive investments or be the registered owner of assets, such as intellectual property, or ships. Shell companies may be registered to the address of a company that provides a service setting up shell companies, and which may act as the agent for receipt of legal correspondence. The company may serve as a vehicle for business transactions without itself having any significant assets or operations. Sometimes shell companies are used for tax evasion, tax avoidance, and money laundering, or to achieve a specific goal such as anonymity. Anonymity may be sought to shield personal assets from others, such as a spouse when a marriage is breaking down, from creditors, from government authorities, besides others.

W

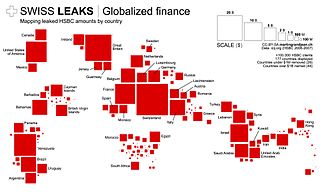

WSwiss Leaks is the name of a journalistic investigation, released in February 2015, of a giant tax evasion scheme allegedly operated with the knowledge and encouragement of the British multinational bank HSBC via its Swiss subsidiary, HSBC Private Bank (Suisse). Triggered by leaked information from French computer analyst Hervé Falciani on accounts held by over 100,000 clients and 20,000 offshore companies with HSBC in Geneva, the disclosed information has been called "the biggest leak in Swiss banking history".

W

WThe Tax Justice Network is an advocacy group consisting of a coalition of researchers and activists with a shared concern about tax avoidance, tax competition, and tax havens.

W

WThe anti-fiscal riot is a form of popular protest very common during the Ancien Régime, the bourgeois revolutions, and the 19th century, characterized by the use of direct collective action to prevent the collection of taxes.

W

WUgland House is a building located in George Town, Cayman Islands. Located at 121 South Church Street, the building is occupied by the law firm Maples and Calder and is the registered office address for 40,000 entities, including many major investment funds, international joint ventures and capital market issuers.

W

WWindow tax was a property tax based on the number of windows in a house. It was a significant social, cultural, and architectural force in England, France, and Ireland during the 18th and 19th centuries. To avoid the tax, some houses from the period can be seen to have bricked-up window-spaces. In England and Wales it was introduced in 1696 and was repealed 155 years later, in 1851. In France it was established in 1798 and was repealed in 1926. Scotland had window tax from 1748 until 1798.