W

WIn economics, a commodity is an economic good, usually a resource, that has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them.

W

WIn the field of economics, the commodity value of a good is its free market intrinsic value under optimal use conditions. In a free market, the commodity value of a good will be reflected by its price. For example, if an acre of land can yield a net of 100 dollars loss by lying fallow, 50 dollars gain by being planted with corn, and 100 dollars gain by being planted with wheat, then that acre's commodity value is 100 dollars; the farmer is assumed to put his land to best use. The price of a commodity fluctuates around its commodity value.

W

WThe value of diamonds as an investment is of significant interest to the general public, because they are expensive gemstones, often purchased in engagement rings, due in part to a successful 20th-century marketing campaign by De Beers. The difficulty of properly assessing the value of an individual gem-quality diamond complicates the situation. The end of the De Beers monopoly and new diamond discoveries in the second half of the 20th century have reduced the resale value of diamonds. Recessions have engendered greater interest in investments that exhibit safe-haven or hedging properties that are uncorrelated to investments in the equities markets. Academic studies have indicated that investments in physical diamonds exhibit greater safe-haven characteristics than investments in diamond indices.

W

WETF Securities is an asset management firm that issues exchange-traded funds (ETFs) primarily in Australia.

W

WOf all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the use of futures contracts and derivatives. The gold market is subject to speculation and volatility as are other markets. Compared to other precious metals used for investment, gold has been the most effective safe haven across a number of countries.

W

WLithium is a critical mineral, and will be one of the drivers of the fourth industrial revolution. Lithium company stocks on the worldwide exchanges have rallied well at the end of 2020 and into the beginning of 2021. As lithium carbonate prices make a resurgence, a chemical that is used in the manufacture of electric vehicle (EV) batteries. Lithium is an essential mineral that goes into the manufacture of electric batteries. Lithium supply is expected to fall short of the demand for this metal by 2023. The growing adoption of electric vehicles (EVs) is driving the increasing demand for lithium, significant amounts of lithium supply will need to be brought online to meet demand growth from the lithium market.

W

WPalladium as an investment is much like investments in other precious metals.

W

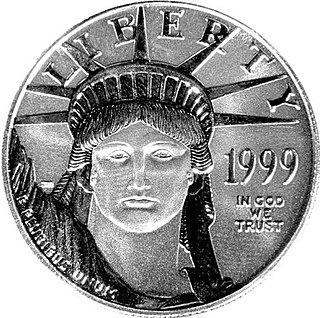

WPlatinum as an investment has a much shorter history in the financial sector than gold or silver, which were known to ancient civilizations. Experts posit that platinum is about 15–20 times scarcer than gold, on the basis of annual mine production. Since 2014, platinum rates have fallen significantly lower than gold rates. More than 75% of global platinum is mined in South Africa.

W

WSilver may be used as an investment like other precious metals. It has been regarded as a form of money and store of value for more than 4,000 years, although it lost its role as legal tender in developed countries when the use of the silver standard came to a final end in 1935. Some countries mint bullion and collector coins, however, such as the American Silver Eagle with nominal face values. In 2009, the main demand for silver was for industrial applications (40%), jewellery, bullion coins, and exchange-traded products. In 2011, the global silver reserves amounted to 530,000 tonnes.