W

WIn economics, marginal cost is the change in the total cost that arises when the quantity produced is incremented by one unit; that is, it is the cost of producing one more unit of a good. Intuitively, marginal cost at each level of production includes the cost of any additional inputs required to produce the next unit. At each level of production and time period being considered, marginal costs include all costs that vary with the level of production, whereas other costs that do not vary with production are fixed and thus have no marginal cost. For example, the marginal cost of producing an automobile will generally include the costs of labor and parts needed for the additional automobile but not the fixed costs of the factory that have already been incurred. In practice, marginal analysis is segregated into short and long-run cases, so that, over the long run, all costs become marginal. Where there are economies of scale, prices set at marginal cost will fail to cover total costs, thus requiring a subsidy. Marginal cost pricing is not a matter of merely lowering the general level of prices with the aid of a subsidy; with or without subsidy it calls for a drastic restructuring of pricing practices, with opportunities for very substantial improvements in efficiency at critical points.

W

WThe marginal efficiency of capital (MEC) is that rate of discount which would equate the price of a fixed capital asset with its present discounted value of expected income.

W

WIn economics and in particular neoclassical economics, the marginal product or marginal physical productivity of an input is the change in output resulting from employing one more unit of a particular input, assuming that the quantities of other inputs are kept constant.

W

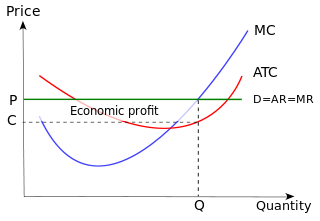

WIn microeconomics, marginal profit is the increment to profit resulting from a unit or infinitessimal increment to the quantity of a product produced. Under the marginal approach to profit maximization, to maximize profits, a firm should continue to produce a good or service up to the point where marginal profit is zero. At any lesser quantity of output, marginal profit is positive and so profit can be increased by producing a greater amount; likewise, at any quantity of output greater than the one at which marginal profit equals zero, marginal profit is negative and so profit could be made higher by producing less.

W

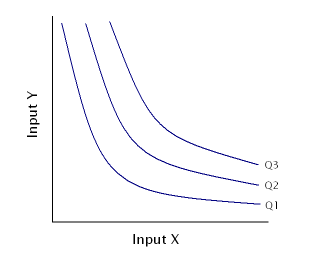

WIn microeconomic theory, the marginal rate of technical substitution (MRTS)—or technical rate of substitution (TRS)—is the amount by which the quantity of one input has to be reduced when one extra unit of another input is used, so that output remains constant.

W

WA production–possibility frontier (PPF), production possibility curve (PPC), or production possibility boundary (PPB), or Transformation curve/boundary/frontier is a curve which shows various combinations of the amounts of two goods which can be produced within the given resources and technology/a graphical representation showing all the possible options of output for two products that can be produced using all factors of production, where the given resources are fully and efficiently utilized per unit time. A PPF illustrates several economic concepts, such as allocative efficiency, economies of scale, opportunity cost, productive efficiency, and scarcity of resources.

W

WMarginal revenue is a central concept in microeconomics that describes the additional total revenue generated by increasing product sales by 1 unit. To derive the value of marginal revenue, it is required to examine the difference between the aggregate benefits a firm received from the quantity of a good and service produced last period and the current period with one extra unit increase in the rate of production. Marginal revenue is a fundamental tool for economic decision making within a firm's setting, together with marginal cost to be considered.