W

WFinancial accounting is the field of accounting concerned with the summary, analysis and reporting of financial transactions related to a business. This involves the preparation of financial statements available for public use. Stockholders, suppliers, banks, employees, government agencies, business owners, and other stakeholders are examples of people interested in receiving such information for decision making purposes.

W

WAccounting or accountancy is the measurement, processing, and communication of financial and non financial information about economic entities such as businesses and corporations. Accounting, which has been called the "language of business", measures the results of an organization's economic activities and conveys this information to a variety of users, including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms "accounting" and "financial reporting" are often used as synonyms.

W

WAn associate company in accounting and business valuation is a company in which another company owns a significant portion of voting shares, usually 20–50%. In this case, an owner does not consolidate the associate's financial statements. Ownership of over 50% creates a subsidiary, with its financial statements being consolidated into the parent's books. Associate value is reported in the balance sheet as an asset, the investor's proportional share of the associate's income is reported in the income statement and dividends from the ownership decrease the value on the balance sheet. In Europe, investments into associate companies are called fixed financial assets.

W

WBig Bath in accounting is an earnings management technique whereby a one-time charge is taken against income in order to reduce assets, which results in lower expenses in the future. The write-off removes or reduces the asset from the financial books and results in lower net income for that year. The objective is to ‘take one big bath’ in a single year so future years will show increased net income.

W

WIn business, consolidation or amalgamation is the merger and acquisition of many smaller companies into a few much larger ones. In the context of financial accounting, consolidation refers to the aggregation of financial statements of a group company as consolidated financial statements. The taxation term of consolidation refers to the treatment of a group of companies and other entities as one entity for tax purposes. Under the Halsbury's Laws of England, 'amalgamation' is defined as "a blending together of two or more undertakings into one undertaking, the shareholders of each blending company, becoming, substantially, the shareholders of the blended undertakings. There may be amalgamations, either by transfer of two or more undertakings to a new company, or to the transfer of one or more companies to an existing company".

W

WEquity method in accounting is the process of treating investments in associate companies. Equity accounting is usually applied where an investor entity holds 20–50% of the voting stock of the associate company, and therefore has significant influence on the latter's management. Under International Financial Reporting Standards, equity method is also required in accounting for joint ventures. The investor records such investments as an asset on its balance sheet. The investor's proportional share of the associate company's net income increases the investment, and proportional payments of dividends decrease it. In the investor’s income statement Equity accounting may also be appropriate where the investor has a smaller interest, depending on the nature of the actual relationship between the investor and investee. Control of the investee, usually through ownership of more than 50% of voting stock, results in recognition of a subsidiary, whose financial statements must be consolidated with the parent's. The ownership of less than 20% creates an investment position, carried at historic book or fair market value in the investor's balance sheet.

W

WA 'financial audit' is conducted to provide an opinion whether "financial statements" are stated in accordance with specified criteria. Normally, the criteria are international accounting standards, although auditors may conduct audits of financial statements prepared using the cash basis or some other basis of accounting appropriate for the organisation. In providing an opinion whether financial statements are fairly stated in accordance with accounting standards, the auditor gathers evidence to determine whether the statements contain material errors or other misstatements.

W

WA fiscal year is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations. Laws in many jurisdictions require company financial reports to be prepared and published on an annual basis but generally not the reporting period to align with the calendar year. Taxation laws generally require accounting records to be maintained and taxes calculated on an annual basis, which usually corresponds to the fiscal year used for government purposes. The calculation of tax on an annual basis is especially relevant for direct taxes, such as income tax. Many annual government fees—such as council tax and license fees, are also levied on a fiscal year basis, but others are charged on an anniversary basis.

W

WWhen two or more individuals engage in enterprise as co-owners, the organization is known as a partnership. This form of organization is popular among personal service enterprises, as well as in the legal and public accounting professions. The important features of and accounting procedures for partnerships are discussed and illustrated below.

W

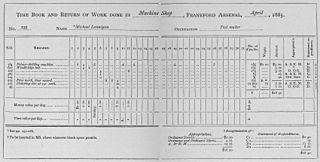

WA time book is a mostly outdated accounting record, that registered the hours worked by employees in a certain organization in a certain period. These records usually contain names of employees, type of work, hours worked, and sometimes wages paid.