W

WAsset-based egalitarianism is a form of egalitarianism which theorises that equality is possible by a redistribution of resources, usually in the form of a capital grant provided at the age of majority. Names for the implementation of this theory in policy include universal basic capital and stakeholding, and are generally synonymous within the equal opportunity egalitarian framework.

W

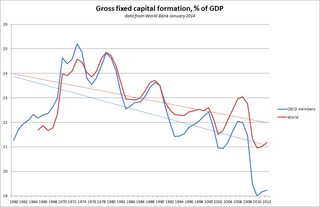

WCapital formation is a concept used in macroeconomics, national accounts and financial economics. Occasionally it is also used in corporate accounts. It can be defined in three ways:It is a specific statistical concept, also known as net investment, used in national accounts statistics, econometrics and macroeconomics. In that sense, it refers to a measure of the net additions to the (physical) capital stock of a country in an accounting interval, or, a measure of the amount by which the total physical capital stock increased during an accounting period. To arrive at this measure, standard valuation principles are used. It is used also in economic theory, as a modern general term for capital accumulation, referring to the total "stock of capital" that has been formed, or to the growth of this total capital stock. In a much broader or vaguer sense, the term "capital formation" has in more recent times been used in financial economics to refer to savings drives, setting up financial institutions, fiscal measures, public borrowing, development of capital markets, privatization of financial institutions, development of secondary markets. In this usage, it refers to any method for increasing the amount of capital owned or under one's control, or any method in utilising or mobilizing capital resources for investment purposes. Thus, capital could be "formed" in the sense of "being brought together for investment purposes" in many different ways. This broadened meaning is not related to the statistical measurement concept nor to the classical understanding of the concept in economic theory. Instead, it originated in credit-based economic growth during the 1990s and 2000s, which was accompanied by the rapid growth of the financial sector, and consequently the increased use of finance terminology in economic discussions.

W

WConstant capital (c), is a concept created by Karl Marx and used in Marxian political economy. It refers to one of the forms of capital invested in production, which contrasts with variable capital (v). The distinction between constant and variable refers to an aspect of the economic role of factors of production in creating a new value.

W

WConsumption of fixed capital (CFC) is a term used in business accounts, tax assessments and national accounts for depreciation of fixed assets. CFC is used in preference to "depreciation" to emphasize that fixed capital is used up in the process of generating new output, and because unlike depreciation it is not valued at historic cost but at current market value ; CFC may also include other expenses incurred in using or installing fixed assets beyond actual depreciation charges. Normally the term applies only to producing enterprises, but sometimes it applies also to real estate assets.

W

WFictitious capital is a concept used by Karl Marx in his critique of political economy. It is introduced in chapter 25 of the third volume of Capital. Fictitious capital contrasts with what Marx calls "real capital", which is capital actually invested in physical means of production and workers, and "money capital", which is actual funds being held. The market value of fictitious capital assets varies according to the expected return or yield of those assets in the future, which Marx felt was only indirectly related to the growth of real production. Effectively, fictitious capital represents "accumulated claims, legal titles, to future production" and more specifically claims to the income generated by that production.Fictitious capital could be defined as a capitalisation on property ownership. Such ownership is real and legally enforced, as are the profits made from it, but the capital involved is fictitious; it is "money that is thrown into circulation as capital without any material basis in commodities or productive activity". Fictitious capital could also be defined as "tradeable paper claims to wealth", although tangible assets may themselves under certain conditions also be vastly inflated in price.

W

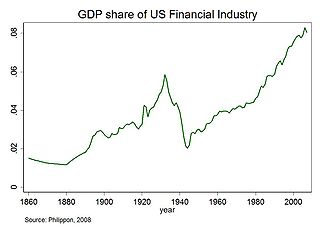

WFinancialization is a term sometimes used to describe the development of financial capitalism during the period from 1980 to present, in which debt-to-equity ratios increased and financial services accounted for an increasing share of national income relative to other sectors.

W

WNatural capital is the world's stock of natural resources, which includes geology, soils, air, water and all living organisms. Some natural capital assets provide people with free goods and services, often called ecosystem services. All of these underpin our economy and society, and thus make human life possible.

W

WThe Natural Capital Committee (NCC) was an independent body set up in 2012, initially for a three-year period, to report to the UK Government and advise on how to value nature and to ensure England's ‘natural wealth’ is managed efficiently and sustainably. During its first term it produced three reports to government on the 'State of Natural Capital'. It has called on the Office for National Statistics to integrate the state of the country's natural assets into mainstream national accounting.

W

WPatient capital is another name for long term capital. With patient capital, the investor is willing to make a financial investment in a business with no expectation of turning a quick profit. Instead, the investor is willing to forgo an immediate return in anticipation of more substantial returns down the road. Prominent examples of patient capital includes pensions, sovereign wealth funds, and university endowments. Governments with access to patient capital may have greater manuevrability in formulating domestic economic policies.

W

WIn sociology and anthropology, symbolic capital can be referred to as the resources available to an individual on the basis of honor, prestige or recognition, and serves as value that one holds within a culture. A war hero, for example, may have symbolic capital in the context of running for political office.

W

WWealth inequality in the United States, also known as the wealth gap, is the unequal distribution of assets among residents of the United States. Wealth commonly includes the values of any homes, automobiles, personal valuables, businesses, savings, and investments, as well as any associated debts. As of Q3 2019, the top 10% of households held 70% of the country's wealth, while the bottom 50% held 2%. From an international perspective, the difference in US median and mean wealth per adult is over 600%.