W

WThe Great Recession was a period of marked general decline (recession) observed in national economies globally that occurred between 2007 and 2009. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. One result was a serious disruption of normal international relations.

W

WFrom the mid-1980s to September 2003, the inflation-adjusted price of a barrel of crude oil on NYMEX was generally under US$25/barrel in 2008 dollars. During 2003, the price rose above $30, reached $60 by 11 August 2005, and peaked at $147.30 in July 2008. Commentators attributed these price increases to many factors, including Middle East tension, soaring demand from China, the falling value of the U.S. dollar, reports showing a decline in petroleum reserves, worries over peak oil, and financial speculation.

W

WWorld food prices increased dramatically in 2007 and the first and second quarter of 2008, creating a global crisis and causing political and economic instability and social unrest in both poor and developed nations. Although the media spotlight focused on the riots that ensued in the face of high prices, the ongoing crisis of food insecurity had been years in the making. Systemic causes for the worldwide increases in food prices continue to be the subject of debate. After peaking in the second quarter of 2008, prices fell dramatically during the late-2000s recession but increased during late 2009 and 2010, reaching new heights in 2011 and 2012 at a level slightly higher than the level reached in 2008. Over the next years, prices fell, reaching a low in March 2016 with the deflated Food and Agriculture Organization (FAO) food price index close to pre-crisis level of 2006.

W

WAPEC Peru 2008 was a series of political meetings held around Peru between the 21 member economies of the Asia-Pacific Economic Cooperation during 2008. Although business leaders of the region also met before the summit officially began. Leaders from all the member countries met during November 22–23, 2008, in the capital city of Lima.

W

WBuilding the Education Revolution (BER) is an Australian government program administered by the Department of Education, Employment and Workplace Relations (DEEWR) designed to provide new and refurbished infrastructure to all eligible Australian schools. The program was part of the Rudd government's economic stimulus package designed as a response to the 2007–2010 global financial crisis.

W

WChimerica is a neologism and portmanteau coined by Niall Ferguson and Moritz Schularick describing the symbiotic relationship between China and the United States, with incidental reference to the legendary chimera. Though the term is largely in reference to economics, there is also a political element.

W

WThe China–Japan–South Korea trilateral summit is an annual summit meeting held between China, Japan and South Korea, three major countries in East Asia. The first summit was held during December 2008 in Fukuoka, Japan. The talks are focused on maintaining strong trilateral relations, the regional economy and disaster relief.

W

WThe Digital Education Revolution (DER) was an Australian government–funded educational reform program, promised by then prime minister of Australia Kevin Rudd during the launch of his 2007 Australian federal election campaign in Brisbane. It was officially launched in late 2008, with the first deployments announced by then Deputy Prime Minister of Australia and Minister for Education, Employment and Workplace Relations, Julia Gillard and then New South Wales counterpart, Verity Firth. The first deployment took place at Fairvale High School in August that year.

W

WBetween May 2006 and the end of 2012 there were sixty-seven finance company collapses in New Zealand; including companies entering into liquidation, receivership or moratoria. An inquiry by the New Zealand Parliament estimated losses at over $3 billion that affected between 150,000 and 200,000 depositors. The most high-profile collapses were South Canterbury Finance, Hanover Finance and Bridgecorp Holdings. The collapse radically reduced the size and importance of the non-bank finance sector in New Zealand. According to the Reserve Bank, at the height of financial expansion prior to the 2007 crisis, non-bank lenders had assets of about $25 billion and made up 8 percent of lending by financial institutions. By late 2013 the size of the finance sector was half its previous size and accounted for only 3 percent of institutional lending. In the years following the beginning of the collapses, sweeping legislative and regulatory changes were made, aimed at improving oversight and regulation of the finance industry.

W

WThe financial crisis of 2007–2008, also known as the global financial crisis (GFC), was a severe worldwide economic crisis. Prior to the COVID-19 recession in 2020, it was considered by many economists to have been the most serious financial crisis since the Great Depression. Predatory lending targeting low-income homebuyers, excessive risk-taking by global financial institutions, and the bursting of the United States housing bubble culminated in a "perfect storm". Mortgage-backed securities (MBS) tied to American real estate, as well as a vast web of derivatives linked to those MBS, collapsed in value. Financial institutions worldwide suffered severe damage, reaching a climax with the bankruptcy of Lehman Brothers on September 15, 2008, and a subsequent international banking crisis.

W

WThe Financial Stability and Development Committee is a Chinese financial regulatory body under the State Council.

W

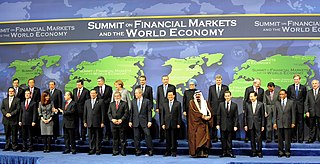

WThe 2008 G20 Washington Summit on Financial Markets and the World Economy took place on November 14–15, 2008, in Washington, D.C., United States. It achieved general agreement amongst the G20 on how to cooperate in key areas so as to strengthen economic growth, deal with the 2008 financial crisis, and lay the foundation for reform to avoid similar crises in the future. The Summit resulted from an initiative by the French and European Union President, Nicolas Sarkozy, Australian Prime Minister Kevin Rudd, and the British Prime Minister, Gordon Brown. In connection with the G7 finance ministers on October 11, 2008, United States President George W. Bush stated that the next meeting of the G20 would be important in finding solutions to the economic crisis. Since many economists and politicians called for a new Bretton Woods system to overhaul the world's financial structure, the meeting has sometimes been described by the media as Bretton Woods II.

W

WHaigui is a Chinese language slang term for Chinese people who have returned to mainland China after having studied abroad for several years. These graduates from foreign universities used to be highly sought out by employers in China, but at least one study has indicated they are now less likely to receive callback from jobs compared to Chinese students with a Chinese degree, possibly because the salary demands of haigui are considered unrealistically high by some employers.

W

WThomas Herndon is an assistant professor of economics at Loyola Marymount University, who, as a graduate student at the University of Massachusetts, became known for critiquing "Growth in a Time of Debt", a widely cited academic paper by Carmen Reinhart and Kenneth Rogoff supporting the austerity policies implemented by governments in Europe and North America in the early 21st century. His research concluded that these measures may not have been necessary.

W

WIFRS 9 is an International Financial Reporting Standard (IFRS) published by the International Accounting Standards Board (IASB). It addresses the accounting for financial instruments. It contains three main topics: classification and measurement of financial instruments, impairment of financial assets and hedge accounting. The standard came into force on 1 January 2018, replacing the earlier IFRS for financial instruments, IAS 39.

W

WIFRS 10, IFRS 11 and IFRS 12 are three International Financial Reporting Standards (IFRS) promulgated by the International Accounting Standards Board (IASB) providing accounting guidance related to consolidation and joint ventures. The standards were issued in 2011 and became effective in 2013. IFRS 10 addresses consolidated financial statements, IFRS 11 addresses joint ventures and IFRS 12 address disclosures of interests in other entities. The standards were developed in part in response to the financial crisis of 2008. During the crisis, accounting rules were criticized for permitting certain risky arrangements to be excluded from company balance sheets. IFRS 10 revised the definition of having "control" of another entity, and thus requiring that entity to be consolidated onto the controlling entity's balance sheet. The revised definition is expected to increase the likelihood that an entity is deemed to have control over another. IFRS 11 largely retained previous accounting guidance for joint ventures, but adopted the IFRS 10 definition of "control," meaning that "joint control" would be deemed to exist in some circumstances where it wasn't previously, and vice versa. IFRS 12 requires the disclosures related to subsidiaries, joint ventures and interests in other entities which are not consolidated to be combined into a single disclosure. It also requires disclosures about judgements used to determine whether control exists, why it determined that control did not exist and its relationship with entities it did not consolidate. These extra disclosures were also in response of criticism of the previous accounting guidance in light of the financial crisis.

W

WIFRS 10, IFRS 11 and IFRS 12 are three International Financial Reporting Standards (IFRS) promulgated by the International Accounting Standards Board (IASB) providing accounting guidance related to consolidation and joint ventures. The standards were issued in 2011 and became effective in 2013. IFRS 10 addresses consolidated financial statements, IFRS 11 addresses joint ventures and IFRS 12 address disclosures of interests in other entities. The standards were developed in part in response to the financial crisis of 2008. During the crisis, accounting rules were criticized for permitting certain risky arrangements to be excluded from company balance sheets. IFRS 10 revised the definition of having "control" of another entity, and thus requiring that entity to be consolidated onto the controlling entity's balance sheet. The revised definition is expected to increase the likelihood that an entity is deemed to have control over another. IFRS 11 largely retained previous accounting guidance for joint ventures, but adopted the IFRS 10 definition of "control," meaning that "joint control" would be deemed to exist in some circumstances where it wasn't previously, and vice versa. IFRS 12 requires the disclosures related to subsidiaries, joint ventures and interests in other entities which are not consolidated to be combined into a single disclosure. It also requires disclosures about judgements used to determine whether control exists, why it determined that control did not exist and its relationship with entities it did not consolidate. These extra disclosures were also in response of criticism of the previous accounting guidance in light of the financial crisis.

W

WIFRS 10, IFRS 11 and IFRS 12 are three International Financial Reporting Standards (IFRS) promulgated by the International Accounting Standards Board (IASB) providing accounting guidance related to consolidation and joint ventures. The standards were issued in 2011 and became effective in 2013. IFRS 10 addresses consolidated financial statements, IFRS 11 addresses joint ventures and IFRS 12 address disclosures of interests in other entities. The standards were developed in part in response to the financial crisis of 2008. During the crisis, accounting rules were criticized for permitting certain risky arrangements to be excluded from company balance sheets. IFRS 10 revised the definition of having "control" of another entity, and thus requiring that entity to be consolidated onto the controlling entity's balance sheet. The revised definition is expected to increase the likelihood that an entity is deemed to have control over another. IFRS 11 largely retained previous accounting guidance for joint ventures, but adopted the IFRS 10 definition of "control," meaning that "joint control" would be deemed to exist in some circumstances where it wasn't previously, and vice versa. IFRS 12 requires the disclosures related to subsidiaries, joint ventures and interests in other entities which are not consolidated to be combined into a single disclosure. It also requires disclosures about judgements used to determine whether control exists, why it determined that control did not exist and its relationship with entities it did not consolidate. These extra disclosures were also in response of criticism of the previous accounting guidance in light of the financial crisis.

W

WIFRS 10, IFRS 11 and IFRS 12 are three International Financial Reporting Standards (IFRS) promulgated by the International Accounting Standards Board (IASB) providing accounting guidance related to consolidation and joint ventures. The standards were issued in 2011 and became effective in 2013. IFRS 10 addresses consolidated financial statements, IFRS 11 addresses joint ventures and IFRS 12 address disclosures of interests in other entities. The standards were developed in part in response to the financial crisis of 2008. During the crisis, accounting rules were criticized for permitting certain risky arrangements to be excluded from company balance sheets. IFRS 10 revised the definition of having "control" of another entity, and thus requiring that entity to be consolidated onto the controlling entity's balance sheet. The revised definition is expected to increase the likelihood that an entity is deemed to have control over another. IFRS 11 largely retained previous accounting guidance for joint ventures, but adopted the IFRS 10 definition of "control," meaning that "joint control" would be deemed to exist in some circumstances where it wasn't previously, and vice versa. IFRS 12 requires the disclosures related to subsidiaries, joint ventures and interests in other entities which are not consolidated to be combined into a single disclosure. It also requires disclosures about judgements used to determine whether control exists, why it determined that control did not exist and its relationship with entities it did not consolidate. These extra disclosures were also in response of criticism of the previous accounting guidance in light of the financial crisis.

W

WFollowing the global financial crisis of 2007–2008, there was a worldwide resurgence of interest in Keynesian economics among prominent economists and policy makers. This included discussions and implementation of economic policies in accordance with the recommendations made by John Maynard Keynes in response to the Great Depression of the 1930s, most especially fiscal stimulus and expansionary monetary policy.

W

WThe bankruptcy of Lehman Brothers on September 15, 2008 was the climax of the subprime mortgage crisis. After the financial services firm was notified of a pending credit downgrade due to its heavy position in subprime mortgages, the Federal Reserve summoned several banks to negotiate financing for its reorganization. These discussions failed, and Lehman filed a Chapter 11 petition that remains the largest bankruptcy filing in U.S. history, involving more than US$600 billion in assets.

W

WThe Madoff investment scandal was a major case of stock and securities fraud discovered in late 2008. In December of that year, Bernie Madoff, the former NASDAQ chairman and founder of the Wall Street firm Bernard L. Madoff Investment Securities LLC, admitted that the wealth management arm of his business was an elaborate multi-billion-dollar Ponzi scheme.

W

WThe 2008–2014 Spanish financial crisis, also known as the Great Recession in Spain or the Great Spanish Depression, began in 2008 during the world financial crisis of 2007–08. In 2012, it made Spain a late participant in the European sovereign debt crisis when the country was unable to bail out its financial sector and had to apply for a €100 billion rescue package provided by the European Stability Mechanism (ESM).

W

WThe Terra Securities scandal was a scandal that became public in November 2007. It involved highly speculative investments by eight municipalities of Norway in various hedge funds in the United States bond market. The funds were sold by Terra Securities to the municipalities, while the products were delivered by Citigroup. The municipalities involved were Narvik, Rana, Hattfjelldal and Hemnes in Nordland, Vik and Bremanger in Sogn og Fjordane, Haugesund in Rogaland, and Kvinesdal in Vest-Agder, all large producers of hydroelectricity.

W

W"Too big to fail" (TBTF) is a theory in banking and finance that asserts that certain corporations, particularly financial institutions, are so large and so interconnected that their failure would be disastrous to the greater economic system, and that they therefore must be supported by governments when they face potential failure. The colloquial term "too big to fail" was popularized by U.S. Congressman Stewart McKinney in a 1984 Congressional hearing, discussing the Federal Deposit Insurance Corporation's intervention with Continental Illinois. The term had previously been used occasionally in the press, and similar thinking had motivated earlier bank bailouts.