W

WPersonal finance is the financial management which an individual or a family unit performs to budget, save, and spend monetary resources over time, taking into account various financial risks and future life events.

W

WThe American Academy of Financial Management (AAFM) was a US-based board of standards, certifying body, and accreditation council focused on the finance sector and management professionals. It was criticized in The Wall Street Journal as having low requirements for the credentials it confers and for excessive claims of links to other associations and industry experts. AAFM was superseded by the Global Academy of Finance and Management.

W

WThe term annual percentage rate of charge (APR), corresponding sometimes to a nominal APR and sometimes to an effective APR (EAPR), is the interest rate for a whole year (annualized), rather than just a monthly fee/rate, as applied on a loan, mortgage loan, credit card, etc. It is a finance charge expressed as an annual rate. Those terms have formal, legal definitions in some countries or legal jurisdictions, but in the United States:The nominal APR is the simple-interest rate. The effective APR is the fee+compound interest rate.

W

WIn Keynesian economics, the average propensity to save (APS), also known as the savings ratio, is the proportion of income which is saved, usually expressed for household savings as a fraction of total household disposable income.

W

WBanking secrecy, alternately known as financial privacy, banking discretion, or bank safety, is a conditional agreement between a bank and its clients that all foregoing activities remain secure, confidential, and private. Most often associated with banking in Switzerland, banking secrecy is prevalent in Luxembourg, Monaco, Hong Kong, Singapore, Ireland, and Lebanon, among other off-shore banking institutions.

W

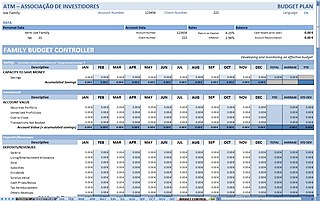

WA personal budget or home budget is a finance plan that allocates future personal income towards expenses, savings and debt repayment. Past spending and personal debt are considered when creating a personal budget. There are several methods and tools available for creating, using and adjusting a personal budget. For example, jobs are an income source, while bills and rent payments are expenses...

W

WThe car internal costs are all the costs consumers pay to own and operate a car. Normally these expenditures are divided by fixed or standing costs and variable or running costs. Fixed costs are those ones which do not depend on the distance traveled by the vehicle and which the owner must pay to keep the vehicle ready for use on the road, like insurance or road taxes. Variable or running costs are those that depend on the use of the car, like fuel or tolls.

W

WA Certificate of Life is a certificate produced by a trusted entity to confirm that an individual was alive at the time of its creation.

W

WCost of living is the cost of maintaining a certain standard of living. Changes in the cost of living over time are often operationalized in a cost-of-living index. Cost of living calculations are also used to compare the cost of maintaining a certain standard of living in different geographic areas. Differences in cost of living between locations can also be measured in terms of purchasing power parity rates.

W

WCourt auction is an auction which takes place at a public location designated by the court.

W

WCredit counseling is commonly a process that is used to help individual debtors with debt settlement through education, budgeting and the use of a variety of tools with the goal to reduce and ultimately eliminate debt. Credit counseling is most often done by Credit counseling agencies that are empowered by contract to act on behalf of the debtor to negotiate with creditors to resolve debt that is beyond a debtor's ability to pay. Some of the agencies are non-profits that charge at no or non-fee rates, while others can be for-profit and include high fees. Regulations on credit counseling and Credit counseling agencies varies by country and sometimes within regions of the countries themselves. In the United States, individuals filing Chapter 13 bankruptcy are required to receive counseling.

W

WDebt management plan (DMP) is an agreement between a debtor and a creditor that addresses the terms of an outstanding debt. This commonly refers to a personal finance process of individuals addressing high consumer debt. Debt management plans help reduce outstanding, unsecured debts over time to help the debtor regain control of finances. The process can secure a lower overall interest rate, longer repayment terms, or an overall reduction in the debt itself.

W

WFinancial independence is the status of having enough income to pay one's living expenses for the rest of one's life without having to be employed or dependent on others. Income earned without having to work a job is commonly referred to as passive income.

W

WIn general usage, a financial plan is a comprehensive evaluation of an individual's current pay and future financial state by using current known variables to predict future income, asset values and withdrawal plans. This often includes a budget which organizes an individual's finances and sometimes includes a series of steps or specific goals for spending and saving in the future. This plan allocates future income to various types of expenses, such as rent or utilities, and also reserves some income for short-term and long-term savings. A financial plan is sometimes referred to as an investment plan, but in personal finance, a financial plan can focus on other specific areas such as risk management, estates, college, or retirement.

W

WA gift card also known as gift certificate in North America, or gift voucher or gift token in the UK is a prepaid stored-value money card, usually issued by a retailer or bank, to be used as an alternative to cash for purchases within a particular store or related businesses. Gift cards are also given out by employers or organizations as rewards or gifts. They may also be distributed by retailers and marketers as part of a promotion strategy, to entice the recipient to come in or return to the store, and at times such cards are called cash cards. Gift cards are generally redeemable only for purchases at the relevant retail premises and cannot be cashed out, and in some situations may be subject to an expiry date or fees. American Express, MasterCard, and Visa offer generic gift cards which need not be redeemed at particular stores, and which are widely used for cashback marketing strategies. A feature of these cards is that they are generally anonymous and are disposed of when the stored value on a card is exhausted.

W

WHiddenLevers is a financial technology company with headquarters in Atlanta. It provides risk applications and analytics to financial advisors, portfolio managers and executive teams in the wealth management space. Users of the HiddenLevers platform access a correlations engine through an easy user interface to understand the drivers of upside and downside in individual portfolios, and across a whole book of business for an advisor or a wealth management institution. HiddenLevers has received critical acclaim for its investment proposal generation and its business intelligence platform that marries risk and revenue analytics. HiddenLevers is also known for its scenario library, a visual compendium of several economic outcomes in the financial zeitgeist, created and updated by the HiddenLevers economic research team. As of April 2019, the company remains self-funded, against a backdrop of record investment in fintech worldwide, hitting $55 billion in 2018, double the year before.

W

WAn incentive is something that motivates or drives one to do something or behave in a certain way. There are two types of incentives that affect human decision making. These are: intrinsic and extrinsic incentives. Intrinsic incentives are those that motivate a person to do something out of their own self interest or desires, without any outside pressure or promised reward. However, extrinsic incentives are motivated by rewards such as an increase in pay for achieving a certain result; or avoiding punishments such as disciplinary action or criticism as a result of not doing something.

W

WInternational Personal Finance is a British-based international home credit business and digital business. It is listed on the London Stock Exchange. It took a secondary listing on the Warsaw Stock Exchange in March 2013. It has a head office in Leeds, West Yorkshire.

W

WThe loan-to-value (LTV) ratio is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased.

W

WMoney Management International (MMI) is a United States non-profit that provides consumers with free credit counseling and education. In about 25 percent of its consultations, it helps consumers develop a debt management or repayment plan. MMI is funded primarily by creditors. Money Management International was founded in 1997 by six financial consulting organizations that were members of the Consumer Credit Counseling Services (CCCS) network.

W

WThe Pan-European Pension Product (PEPP) or like Pan-European Personal Pension Product is a proposed pension which will be available to residents of the European Union. The PEPP is designed to give the 240 million savers in the EU a better choice in the fragmented and uneven European market, where options are nearly non-existent in some member states. PEPPs are regulated by the Regulation 2019/1238. This regulation lays the legal foundation for a single European market for personal pensions. The PEPP will be complementary to existing state, occupational and private pension systems on national level. After endorsement by the European Parliament and official adoption by the European Council the PEPP regulation was published in July 2019 and will enter into application in August 2020. The first PEPPs are expected to be offered in late 2021.

W

WA pension is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement.

W

WA Premium Bond is a lottery bond issued by the United Kingdom government since 1956. At present it is issued by the government's National Savings and Investments agency.

W

WRich Dad Poor Dad is a 1997 book written by Robert Kiyosaki and Sharon Lechter. It advocates the importance of financial literacy, financial independence and building wealth through investing in assets, real estate investing, starting and owning businesses, as well as increasing one's financial intelligence.

W

WSaving is income not spent, or deferred consumption. Methods of saving include putting money aside in, for example, a deposit account, a pension account, an investment fund, or as cash. Saving also involves reducing expenditures, such as recurring costs. In terms of personal finance, saving generally specifies low-risk preservation of money, as in a deposit account, versus investment, wherein risk is a lot higher; in economics more broadly, it refers to any income not used for immediate consumption. Saving does not automatically include interest.

W

WSimple living encompasses a number of different voluntary practices to simplify one's lifestyle. These may include, for example, reducing one's possessions, generally referred to as minimalism, or increasing self-sufficiency. Simple living may be characterized by individuals being satisfied with what they have rather than want. Although asceticism generally promotes living simply and refraining from luxury and indulgence, not all proponents of simple living are ascetics. Simple living is distinct from those living in forced poverty, as it is a voluntary lifestyle choice.

W

WA student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. It also differs in many countries in the strict laws regulating renegotiating and bankruptcy. This article highlights the differences of the student loan system in several major countries.

W

W"Take a penny, leave a penny" refers to a type of tray, dish or cup meant for convenience in cash transactions. They are often found in the United States in gas stations, convenience stores, and other small stores, and were similarly common in Canada before the penny went out of circulation in 2013.

W

WA Totten trust is a form of trust in the United States in which one party places money in a bank account or security with instructions that upon the settlor's death, whatever is in that account will pass to a named beneficiary. For example, a Totten trust arises when a bank account is titled in the form "[depositor], in trust for [beneficiary]".

W

WA turn-off notice, cut-off notice, or shut-off notice is a warning letter sent out by the provider of a service for a residence or other building, such as utility, phone service, or cable television, that if payment is not sent by the date indicated in the notice, the service will be interrupted. Turn-off notices, which are sent after a regular bill has been sent, but may resemble a bill, are generally sent several days to weeks before the planned date, giving the customer a sufficient amount of time to make a payment that would avert the interruption.

W

WUalá is a personal financial management mobile app developed in Argentina linked to a Mastercard prepaid card that allows users to conduct financial transactions, such as, transferring money and making payments and purchases, both in Argentina and abroad.

W

WValue investing is an investment paradigm that involves buying securities that appear underpriced by some form of fundamental analysis. The various forms of value investing derive from the investment philosophy first taught by Benjamin Graham and David Dodd at Columbia Business School in 1928, and subsequently developed in their 1934 text Security Analysis.

W

WYou Only Live Once: The Roadmap to Financial Wellness and a Purposeful Life is a 2016 book written by Jason Vitug. The book sets to redefine the YOLO mantra that has been used to define Generation Y or millennials, to set a mindset shift to cultivate a healthy and wealthy lifestyle for a lifetime. The book focuses on a three step process called ACT, an acronym for awareness, creating a plan, and taking control steps, outlined by the author. The books aim is to make readers define the life they want to live before setting financial goals. You Only Live Once: The Roadmap to Financial Wellness and a Purposeful Life is written in a simple conversation tone based on Vitug's financial experiences and conversations with others