W

WMonetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing or the money supply, often as an attempt to reduce inflation or the interest rate, to ensure price stability and general trust of the value and stability of the nation's currency.

W

WIn 1828, Andrew Jackson, who had lost the 1824 election in a runoff in the United States House of Representatives, despite winning both the popular vote and the Electoral vote by significant margins, ran for President of the United States. He had been nominated by the Tennessee state legislature in 1825, and did not face any opposition from Democratic candidates. Jackson launched his campaign on January 8, 1828 with a major speech on the 13th anniversary of the Battle of New Orleans from 1815, thus marking the birth of the modern Democratic Party. Jackson accepted John C. Calhoun, incumbent Vice President under John Quincy Adams, as his running mate.

W

WCarbon quantitative easing (CQE) is an unconventional monetary policy that is featured in a proposed international climate policy, called a global carbon reward. A major goal of CQE is to finance the global carbon reward by managing the exchange rate of a proposed representative currency, called a carbon currency. The carbon currency will be an international unit of account that will represent the mass of carbon that is effectively mitigated and then rewarded under the policy. The carbon currency will function primarily as a store of value and not as a medium of exchange.

W

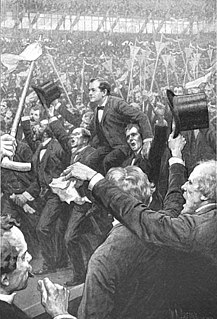

WThe Cross of Gold speech was delivered by William Jennings Bryan, a former United States Representative from Nebraska, at the Democratic National Convention in Chicago on July 9, 1896. In the address, Bryan supported bimetallism or "free silver", which he believed would bring the nation prosperity. He decried the gold standard, concluding the speech, "you shall not crucify mankind upon a cross of gold". Bryan's address helped catapult him to the Democratic Party's presidential nomination; it is considered one of the greatest political speeches in American history.

W

WCurrency depreciation is the loss of value of a country's currency with respect to one or more foreign reference currencies, typically in a floating exchange rate system in which no official currency value is maintained. Currency appreciation in the same context is an increase in the value of the currency. Short-term changes in the value of a currency are reflected in changes in the exchange rate.

W

WA currency board is a monetary authority which is required to maintain a fixed exchange rate with a foreign currency. This policy objective requires the conventional objectives of a central bank to be subordinated to the exchange rate target.

W

WCurrency substitution is the use of a foreign currency in parallel to or instead of a domestic currency. The process is also known as dollarization or euroization when the foreign currency is one of the currencies known as the dollar or is the Euro.

W

WA debasement of coinage is the practice of lowering the intrinsic value of coins, especially when used in connection with commodity money, such as gold or silver coins. A coin is said to be debased if the quantity of gold, silver, copper or nickel in the coin is reduced.

W

WExcess reserves are bank reserves held by a bank in excess of a reserve requirement for it set by a central bank.

W

WThe "Fed model" or "Fed Stock Valuation Model" (FSVM), is a disputed theory of equity valuation that compares the stock market's forward earnings yield to the nominal yield on long-term government bonds, and that the stock market – as a whole – is fairly valued, when the one-year forward-looking I/B/E/S earnings yield equals the 10-year nominal Treasury yield; deviations suggest over-or-under valuation.

W

WFractional-reserve banking is the system of banking operating in almost all countries worldwide, under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserve, and are at liberty to lend the remainder to borrowers. Bank reserves are held as cash in the bank or as balances in the bank's account at the central bank. The country's central bank determines the minimum amount that banks must hold in liquid assets, called the "reserve requirement" or "reserve ratio". Most commercial banks hold more than this minimum amount as excess reserves.

W

WThe Genoa Economic and Financial Conference was a formal conclave of 34 nations held in Genoa, Italy, from 10 April to 19 May 1922 that was planned by British Prime Minister David Lloyd George to resolve the major economic and political issues facing Europe and to deal with the pariah states of Germany and Russia, both of which had been excluded from the Paris Peace Conference of 1919. The conference was particularly interested in developing a strategy to rebuild a defeated Germany, as well as Central and Eastern European states, and to negotiate a relationship between European capitalist economies and the new Bolshevik regime in Soviet Russia. However, Russia and Germany signed the separate Treaty of Rapallo (1922), and the result at Genoa was a fiasco with few positive results. However, the conference came up with a proposal for resuming the gold standard that was largely put in place by major countries.

W

WA gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold foreign central banks, effectively ending the Bretton Woods system. Many states still hold substantial gold reserves.

W

WThe Greenspan put was a monetary policy response to financial crises that Alan Greenspan, former chair of the Federal Reserve, exercised beginning with the crash of 1987. Successful in addressing various crises, it became controversial as it led to periods of extreme speculation led by Wall Street investment banks overusing the put's repurchase agreements and creating successive asset price bubbles. The banks so overused Greenspan's tools that their compromised solvency in the global financial crisis required Fed chair Ben Bernanke to use direct quantitative easing. The term Yellen put was used to refer to the Fed chair Janet Yellen's policy of perpetual monetary looseness.

W

WHard money policies support a specie standard, usually gold or silver, typically implemented with representative money.

W

WHelicopter money is a proposed unconventional monetary policy, sometimes suggested as an alternative to quantitative easing (QE) when the economy is in a liquidity trap. Although the original idea of helicopter money describes central banks making payments directly to individuals, economists have used the term 'helicopter money' to refer to a wide range of different policy ideas, including the 'permanent' monetization of budget deficits – with the additional element of attempting to shock beliefs about future inflation or nominal GDP growth, in order to change expectations. A second set of policies, closer to the original description of helicopter money, and more innovative in the context of monetary history, involves the central bank making direct transfers to the private sector financed with base money, without the direct involvement of fiscal authorities. This has also been called a citizens' dividend or a distribution of future seigniorage.

W

WAn interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed. The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed.

W

WIn macroeconomic theory, liquidity preference is the demand for money, considered as liquidity. The concept was first developed by John Maynard Keynes in his book The General Theory of Employment, Interest and Money (1936) to explain determination of the interest rate by the supply and demand for money. The demand for money as an asset was theorized to depend on the interest foregone by not holding bonds. Interest rates, he argues, cannot be a reward for saving as such because, if a person hoards his savings in cash, keeping it under his mattress say, he will receive no interest, although he has nevertheless refrained from consuming all his current income. Instead of a reward for saving, interest, in the Keynesian analysis, is a reward for parting with liquidity. According to Keynes, money is the most liquid asset. Liquidity is an attribute to an asset. The more quickly an asset is converted into money the more liquid it is said to be.

W

WThe Treaty on European Union, commonly known as the Maastricht Treaty, is the foundation treaty of the European Union (EU). Concluded in 1992 between the then twelve member states of the European Communities, it announced "a new stage in the process of European integration" chiefly in provisions for a shared European citizenship, for the eventual introduction of a single currency, and for common foreign and security policies. Although these were widely seen to presage a "federal Europe", the focus of constitutional debate shifted to the later 2007 Treaty of Lisbon. In the wake of the Eurozone debt crisis unfolding from 2009, the most enduring reference to the Maastricht Treaty has been to the rules of compliance – the "Maastricht criteria" – for the currency union.

W

WMonetary hegemony is an economic and political concept in which a single state has decisive influence over the functions of the international monetary system. A monetary hegemon would need:accessibility to international credits, foreign exchange markets the management of balance of payments problems in which the hegemon operates under no balance of payments constraint. the direct power to enforce a unit of account in which economic calculations are made in the world economy.

W

WThe Monetary Policy Council, Polish: Rada Polityki Pieniężnej, (RPP) is a body of Narodowy Bank Polski, the central bank of Poland.

W

WMoney creation, or money issuance, is the process by which the money supply of a country, or of an economic or monetary region, is increased. In most modern economies, most of the money supply is in the form of bank deposits. Central banks monitor the amount of money in the economy by measuring monetary aggregates, consisting of cash and bank deposits. Money creation occurs when the quantity of monetary aggregates increase.

W

WIn macroeconomics, the money supply refers to the total volume of money held by the public at a particular point in time in an economy. There are several ways to define "money", but standard measures usually include currency in circulation and demand deposits. The central bank of each country may use a definition of what constitutes money for its purposes.

W

WNegative interest on excess reserves is an instrument of unconventional monetary policy applied by central banks to encourage lending by making it costly for commercial banks to hold their excess reserves at central banks so they will lend more readily to the private sector. Such a policy is usually a response to very slow economic growth, deflation, and deleveraging.

W

WOpen mouth operations are communications by a central bank that affect Central Bank interest rates. They are a tool of monetary policy. The term was coined by economists Graeme Guthrie and Julian Wright in the year 2000. While looking at the operations and communications of the Reserve Bank of New Zealand, these economists found that communications by the central bank had a much more significant effect on the interest rate than did Central Bank operations. Unbeknownst to most economists, Open Mouth Operations let central banks change interest rates without significantly changing their daily monetary operations. Mario Draghi's 2012 statement that “the ECB will do whatever it takes to preserve the euro, and believe me, it will be enough”, is an example of a successful Open Mouth Operation used to lower the interest rates of Spanish government bonds: following the announcement, Spanish government bond interest rates dropped 352 basis points without the ECB having to purchase them.

W

WThe Phillips curve is a single-equation economic model, named after William Phillips, hypothesizing an inverse relationship between rates of unemployment and corresponding rates of rises in wages that result within an economy. Stated simply, decreased unemployment, in an economy will correlate with higher rates of wage rises. Phillips did not himself state there was any relationship between employment and inflation; this notion was a trivial deduction from his statistical findings. Paul Samuelson and Robert Solow made the connection explicit and subsequently Milton Friedman and Edmund Phelps put the theoretical structure in place. In so doing, Friedman was to successfully predict the imminent collapse of Phillips' a-theoretic correlation.

W

WQuantitative easing (QE) is a monetary policy whereby a central bank purchases predetermined amounts of government bonds or other financial assets in order to inject money into the economy to expand economic activity. Quantitative easing is considered to be an unconventional form of monetary policy, which is usually used when inflation is very low or negative, and when standard monetary policy instruments have become ineffective.

W

WThe sale of UK gold reserves was a policy pursued by HM Treasury over the period between 1999 and 2002, when gold prices were at their lowest in 20 years, following an extended bear market. The period itself has been dubbed by some commentators as the Brown Bottom or Brown's Bottom.

W

WThe shadow rate is an interest rate in some financial models. It is used to measure the economy when nominal interest rates come close to the zero lower bound. It was created by Fischer Black in his final paper, "Interest Rates as Options".

W

WThe silver standard is a monetary system in which the standard economic unit of account is a fixed weight of silver. Silver was far more widespread than gold as the monetary standard worldwide, from the Sumerians c. 3000 BCE until 1873. Following the discovery in the 16th century of large deposits of silver at the Cerro Rico in Potosí, Bolivia, an international silver standard came into existence in conjunction with the Spanish pieces of eight. These silver dollar coins played the role of an international trading currency for nearly four hundred years.

W

WThe Great Debasement (1544–1551) was a currency debasement policy introduced in 1544 England under the order of Henry VIII which saw the amount of precious metal in gold and silver coins reduced and in some cases replaced entirely with cheaper base metals such as copper. Overspending by Henry VIII to pay for his lavish lifestyle and to fund foreign wars with France and Scotland are cited as reasons for the policy's introduction. The main aim of the policy was to increase revenue for the Crown at the cost of taxpayers through savings in currency production with less bullion being required to mint new coins. During debasement gold standards dropped from the previous standard of 23 karat to as low as 20 karat while silver was reduced from 92.5% sterling silver to just 25%. Revoked in 1551 by Edward VI, the policy's economic effects continued for many years until 1560 when all debased currency was removed from circulation.

W

WVittorio Saraceno was an Italian economist and numismatist.

W

WIn 1896, William Jennings Bryan ran unsuccessfully for President of the United States. Bryan, a former Democratic congressman from Nebraska, gained his party's presidential nomination in July of that year after electrifying the Democratic National Convention with his Cross of Gold speech. He was defeated in the general election by the Republican candidate, former Ohio governor William McKinley.

W

WIn 1896, William McKinley was elected President of the United States. McKinley, a Republican and former Governor of Ohio, defeated the joint Democratic and Populist nominee, William Jennings Bryan, as well as minor-party candidates. McKinley's decisive victory in what is sometimes seen as a realigning election ended a period of close presidential contests, and ushered in an era of dominance for the Republican Party.

W

WZero interest-rate policy (ZIRP) is a macroeconomic concept describing conditions with a very low nominal interest rate, such as those in contemporary Japan and December 2008 through December 2015 in the United States. ZIRP is considered to be an unconventional monetary policy instrument and can be associated with slow economic growth, deflation and deleverage.