W

WA financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy.

W

WThe Arendal crash (Arendalskrakket) was an economic crisis in Arendal, Norway, that occurred when the bank Arendals Privatbank went bankrupt in 1886 and the bank's co-owner Axel Nicolai Herlofson was revealed to have defrauded customers and co-owners systemically. The crash led to several other bankruptcies and unemployment in Southern Norway, and marked the end of Arendal as an important shipping town. It took over 80 years to overcome the effects of the crash. Herlofson was sentenced to six years penal labour.

W

WThe Asian financial crisis was a period of financial crisis that gripped much of East Asia and Southeast Asia beginning in July 1997 and raised fears of a worldwide economic meltdown due to financial contagion. However the recovery in 1998–1999 was rapid and worries of a meltdown subsided.

W

WA bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system, numerous customers withdraw cash from deposit accounts with a financial institution at the same time because they believe that the financial institution is, or might become, insolvent; they keep the cash or transfer it into other assets, such as government bonds, precious metals or gemstones. When they transfer funds to another institution, it may be characterized as a capital flight. As a bank run progresses, it generates its own momentum: as more people withdraw cash, the likelihood of default increases, triggering further withdrawals. This can destabilize the bank to the point where it runs out of cash and thus faces sudden bankruptcy. To combat a bank run, a bank may limit how much cash each customer may withdraw, suspend withdrawals altogether, or promptly acquire more cash from other banks or from the central bank, besides other measures.

W

WThe Baring crisis or the Panic of 1890 was an acute recession. Although less serious than other panics of the era, it is the nineteenth century’s most famous sovereign debt crisis, and the 17th largest decline in U.S. stock market history.

W

WThe Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The company's main business areas before its failure were capital markets, investment banking, wealth management, and global clearing services, and it was heavily involved in the subprime mortgage crisis.

W

WBlack Monday is the name commonly given to the global, sudden, severe, and largely unexpected stock market crash on October 19, 1987. In Australia and New Zealand, the day is also referred to as Black Tuesday because of the time zone difference from other English-speaking countries. All of the twenty-three major world markets experienced a sharp decline in October 1987. When measured in United States dollars, eight markets declined by 20 to 29%, three by 30 to 39%, and three by more than 40%. The least affected was Austria while the most affected was Hong Kong with a drop of 45.8%. Out of twenty-three major industrial countries, nineteen had a decline greater than 20%. Worldwide losses were estimated at US$1.71 trillion. The severity of the crash sparked fears of extended economic instability or even a reprise of the Great Depression.

W

WThe Crisis of 1982 was a major economic crisis suffered in Chile during the military government of Chile (1973–1990). Chile's GDP fell 14.3%, and unemployment rose to 23.7%.

W

WDebt crisis is a situation in which a government loses the ability of paying back its governmental debt. When the expenditures of a government are more than its tax revenues for a prolonged period, the government may enter into a debt crisis. Various forms of governments finance their expenditures primarily by raising money through taxation. When tax revenues are insufficient, the government can make up the difference by issuing debt.

W

WThe Diamond–Dybvig model is an influential model of bank runs and related financial crises. The model shows how banks' mix of illiquid assets and liquid liabilities may give rise to self-fulfilling panics among depositors.

W

WThe Dominion of Newfoundland was a country in eastern North America, today the modern Canadian province of Newfoundland and Labrador. It was established on 26 September 1907, and confirmed by the Balfour Declaration of 1926 and the Statute of Westminster of 1931. It included the island of Newfoundland, and Labrador on the continental mainland. Newfoundland was one of the original "dominions" within the meaning of the Balfour Declaration and accordingly enjoyed a constitutional status equivalent to the other dominions of the time.

W

WThe Evergrande liquidity crisis refers to the ongoing financial situation of Chinese property developer Evergrande Group. After a letter circulated online of the company informing the Guangdong government that it was at risk of a cash crunch, shares in the company have plunged in value, with impacts on global markets and a significant slow-down in foreign investment in China during August to October of 2021.

W

WFinancial contagion refers to "the spread of market disturbances – mostly on the downside – from one country to the other, a process observed through co-movements in exchange rates, stock prices, sovereign spreads, and capital flows". Financial contagion can be a potential risk for countries who are trying to integrate their financial system with international financial markets and institutions. It helps explain an economic crisis extending across neighboring countries, or even regions.

W

WThe financial crisis of 2007–2008, also known as the global financial crisis (GFC), was a severe worldwide economic crisis. Prior to the COVID-19 recession in 2020, it was considered by many economists to have been the most serious financial crisis since the Great Depression. Predatory lending targeting low-income homebuyers, excessive risk-taking by global financial institutions, and the bursting of the United States housing bubble culminated in a "perfect storm". Mortgage-backed securities (MBS) tied to American real estate, as well as a vast web of derivatives linked to those MBS, collapsed in value. Financial institutions worldwide suffered severe damage, reaching a climax with the bankruptcy of Lehman Brothers on September 15, 2008, and a subsequent international banking crisis.

W

WGalloping inflation is one that develops at a rapid pace, perhaps only for a brief period of time. Such form of inflation is dangerous for the economy as it mostly affects the middle and low-income classes of population. Importantly, the galloping inflation can precipitate an economic depression. Nevertheless, the galloping inflation can still be accompanied by the real economic growth.

W

WThe Great Depression was a severe worldwide economic depression that took place mostly during the 1930s, beginning in the United States. The timing of the Great Depression varied across the world; in most countries, it started in 1929 and lasted until the late 1930s. It was the longest, deepest, and most widespread depression of the 20th century. The Great Depression is commonly used as an example of how intensely the global economy can decline.

W

WGreece faced a sovereign debt crisis in the aftermath of the financial crisis of 2007–08. Widely known in the country as The Crisis, it reached the populace as a series of sudden reforms and austerity measures that led to impoverishment and loss of income and property, as well as a small-scale humanitarian crisis. In all, the Greek economy suffered the longest recession of any advanced mixed economy to date. As a result, the Greek political system has been upended, social exclusion increased, and hundreds of thousands of well-educated Greeks have left the country.

W

WThe Greek government-debt crisis is one of a number of current European sovereign-debt crises. In late 2009, fears of a sovereign debt crisis developed among investors concerning Greece's ability to meet its debt obligations because of strong increase in government debt levels. This led to a crisis of confidence, indicated by a widening of bond yield spreads and the cost of risk insurance on credit default swaps compared to the other countries in the Eurozone, most importantly Germany.

W

WIn economics, hyperinflation is very high and typically accelerating inflation. It quickly erodes the real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as they usually switch to more stable foreign currencies, such as the US dollar. When measured in stable foreign currencies, prices typically remain stable.

W

WThe Icelandic financial crisis was a major economic and political event in Iceland that involved the default of all three of the country's major privately owned commercial banks in late 2008, following their difficulties in refinancing their short-term debt and a run on deposits in the Netherlands and the United Kingdom. Relative to the size of its economy, Iceland's systemic banking collapse was the largest experienced by any country in economic history. The crisis led to a severe economic slump in 2008–2010 and significant political unrest.

W

WInDefence, also known as In Defence of Iceland, was a grassroots citizen movement formed in October 2008, in the first instance in protest at the Landsbanki Freezing Order 2008, passed at 10 am on 8 October 2008, during the 2008–2011 Icelandic financial crisis.

W

WThe post-2008 Irish economic downturn in the Republic of Ireland, coincided with a series of banking scandals, followed the 1990s and 2000s Celtic Tiger period of rapid real economic growth fuelled by foreign direct investment, a subsequent property bubble which rendered the real economy uncompetitive, and an expansion in bank lending in the early 2000s. An initial slowdown in economic growth amid the international financial crisis of 2007–2008 greatly intensified in late 2008 and the country fell into recession for the first time since the 1980s. Emigration, as did unemployment, escalated to levels not seen since that decade.

W

WThe Latin American debt crisis was a financial crisis that originated in the early 1980s, often known as La Década Perdida, when Latin American countries reached a point where their foreign debt exceeded their earning power, and they were not able to repay it.

W

WThis is a list of bank runs. A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank might fail. As more people withdraw their deposits, the likelihood of default increases, and this encourages further withdrawals. This can destabilize the bank to the point where it faces bankruptcy.

W

WA Minsky moment is a sudden, major collapse of asset values which marks the end of the growth phase of a cycle in credit markets or business activity.

W

WThe Panic of 1819: Reactions and Policies is a 1962 book by the economist Murray Rothbard, in which the author discusses what he calls the first great economic crisis of the United States. The book is based on his doctoral dissertation in economics at Columbia University during the mid-1950s.

W

WThe Panic of 1837 was a financial crisis in the United States that touched off a major depression, which lasted until the mid-1840s. Profits, prices, and wages went down, Westward expansion was stalled, unemployment went up, and pessimism abounded.

W

WThe Panic of 1857 was a financial panic in the United States caused by the declining international economy and over-expansion of the domestic economy. Because of the invention of the telegraph by Samuel F. Morse in 1844, the Panic of 1857 was the first financial crisis to spread rapidly throughout the United States. The world economy was also more interconnected by the 1850s, which also made the Panic of 1857 the first worldwide economic crisis. In Britain, the Palmerston government circumvented the requirements of the Bank Charter Act 1844, which required gold and silver reserves to back up the amount of money in circulation. Surfacing news of this circumvention set off the Panic in Britain.

W

WThe Panic of 1873 was a financial crisis that triggered an economic depression in Europe and North America that lasted from 1873 to 1877 or 1879 in France and in Britain. In Britain, the Panic started two decades of stagnation known as the "Long Depression" that weakened the country's economic leadership. In the United States, the Panic was known as the "Great Depression" until the events of 1929 and the early 1930s set a new standard.

W

WThe Panic of 1884 was an economic panic during the Depression of 1882–1885. It was unusual in that it struck at the end rather than the beginning of the recession. The panic created a credit shortage that led to a significant economic decline in the United States, turning a recession into a depression.

W

WThe Panic of 1893 was an economic depression in the United States that began in 1893 and ended in 1897. It deeply affected every sector of the economy, and produced political upheaval that led to the political realignment of 1896 and the presidency of William McKinley.

W

WThe Panic of 1907 – also known as the 1907 Bankers' Panic or Knickerbocker Crisis – was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange fell almost 50% from its peak the previous year. Panic occurred, as this was during a time of economic recession, and there were numerous runs on banks and trust companies. The 1907 panic eventually spread throughout the nation when many state and local banks and businesses entered bankruptcy. Primary causes of the run included a retraction of market liquidity by a number of New York City banks and a loss of confidence among depositors, exacerbated by unregulated side bets at bucket shops.

W

WThe Panic of 1910–1911 was a minor economic depression that followed the enforcement of the Sherman Antitrust Act, which regulates the competition among enterprises, trying to avoid monopolies and, generally speaking, a failure of the market itself. The short-term panic lasted approximately 1 year and led to a drop of the major U.S. stock market index by ~26%. It mostly affected the stock market and business traders who were smarting from the activities of trust busters, especially with the breakup of the Standard Oil Company and the American Tobacco company.

W

WThe financial crisis in Russia in 2014–2015 was the result of the sharp devaluation of the Russian ruble beginning in the second half of 2014. A decline in confidence in the Russian economy caused investors to sell off their Russian assets, which led to a decline in the value of the Russian ruble and sparked fears of a financial crisis. The lack of confidence in the Russian economy stemmed from at least two major sources. The first is the fall in the price of oil in 2014. Crude oil, a major export of Russia, declined in price by nearly 50% between its yearly high in June 2014 and 16 December 2014. The second is the result of international economic sanctions imposed on Russia following Russia's annexation of Crimea and the Russian military intervention in Ukraine.

W

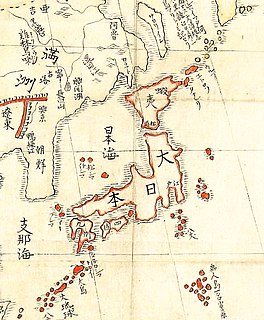

WThe Shōwa Financial Crisis was a financial panic in 1927, during the first year of the reign of Emperor Hirohito of Japan, and was a foretaste of the Great Depression. It brought down the government of Prime Minister Wakatsuki Reijirō and led to the domination of the zaibatsu over the Japanese banking industry.

W

WThe South Sea Company was a British joint-stock company founded in January 1711, created as a public-private partnership to consolidate and reduce the cost of the national debt. To generate income, in 1713 the company was granted a monopoly to supply African slaves to the islands in the "South Seas" and South America. When the company was created, Britain was involved in the War of the Spanish Succession and Spain and Portugal controlled most of South America. There was thus no realistic prospect that trade would take place, and as it turned out, the Company never realised any significant profit from its monopoly. However, Company stock rose greatly in value as it expanded its operations dealing in government debt, and peaked in 1720 before suddenly collapsing to little above its original flotation price. The notorious economic bubble thus created, which ruined thousands of investors, became known as the South Sea Bubble.

W

WThe 2020 stock market crash was a major and sudden global stock market crash that began on 20 February 2020 and ended on 7 April.

W

WThe Toyokawa Shinkin Bank incident was a bank run on Toyokawa Shinkin Bank in what was then Kozakai, Aichi Prefecture, Japan in December 1973.