W

WAlexander Baring, 1st Baron Ashburton, PC, of The Grange in Hampshire, of Ashburton in Devon and of Buckenham Tofts near Thetford in Norfolk, was a British politician and financier, and a member of the Baring family. Baring was the second son of Sir Francis Baring, 1st Baronet, and of Harriet, daughter of William Herring.

W

WBanco di Napoli S.p.A., among the oldest banks in the world, was an Italian banking subsidiary of Intesa Sanpaolo group, as one of the 6 retail brands other than "Intesa Sanpaolo". It was acquired by the Italian banking group Sanpaolo IMI in 2002 and ceased being an independent bank. In February 2018, Intesa Sanpaolo announced their new business plan, which would retire Banco di Napoli and other brands; the legal person of Banco di Napoli would be absorbed into Intesa Sanpaolo S.p.A.

W

WThe Bank of the Holy Spirit was a bank founded by Pope Paul V on December 13, 1605. The bank was the first national bank in Europe, the first public deposit bank in Rome, and the oldest continuously operating bank in Rome until its merger in 1992.

W

WThe Bank of Amsterdam was an early bank, vouched for by the city of Amsterdam, and established in 1609. It was the first public bank to offer accounts not directly convertible to coin. As such, it can be described as the first true central bank. Unlike the Bank of England, established almost a century later, it neither managed the national currency nor acted as a lending institution ; it was intended to defend coinage standard. The role of the Wisselbank was to correctly estimate the value of coins and thus make debasement less profitable. It occupied a central position in the financial world of its day, providing an effective, efficient and trusted system for national and international payments, and introduced the first ever international reserve currency, the bank guilder. The model of the Wisselbank as a state bank was adapted throughout Europe, including the Bank of Sweden (1668) and the Bank of England (1694). David Hume praised the Bank of Amsterdam for its policy of 100 percent specie-backed deposit reserves.

W

WThe Bank of North America was the first chartered bank in the United States, and served as the country's first de facto central bank. Chartered by the Congress of the Confederation on May 26, 1781, and opened in Philadelphia on January 7, 1782, it was based upon a plan presented by US Superintendent of Finance Robert Morris on May 17, 1781, based on recommendations by Revolutionary era figure Alexander Hamilton. Although Hamilton later noted its "essential" contribution to the war effort, the Pennsylvania government objected to its privileges and reincorporated it under state law, making it unsuitable as a national bank under the federal Constitution. Instead Congress chartered a new bank, the First Bank of the United States, in 1791, while the Bank of North America continued as a private concern.

W

WThe Haarlem Bank van Lening is a former city Bank van Lening that has been converted to a restaurant in Haarlem, the Netherlands.

W

WThe Baring crisis or the Panic of 1890 was an acute recession. Although less serious than other panics of the era, it is the nineteenth century’s most famous sovereign debt crisis, and the 17th largest decline in U.S. stock market history.

W

WSir Francis Baring, 1st Baronet was an English merchant banker, a member of the Baring family, later becoming the first of the Baring baronets.

W

WThe Berenberg family was a Flemish-origined Hanseatic family of merchants, bankers and senators in Hamburg, with branches in London, Livorno and other European cities. The family was descended from the brothers Hans and Paul Berenberg from Antwerp, who came as Protestant refugees to the city-republic of Hamburg following the Fall of Antwerp in 1585 and who established what is now Berenberg Bank in Hamburg in 1590. The Berenbergs were originally cloth merchants and became involved in merchant banking in the 17th century. Having existed continuously since 1590, Berenberg Bank is the world's oldest surviving merchant bank.

W

WThe Bethmann family has been remarkable for the high proportion of its male members who succeeded at mercantile or financial endeavors. This family trait began in medieval northern Germany and continued with the Bethmann bank, which Johann Philipp Bethmann (1715–1793) and Simon Moritz Bethmann (1721–1782) founded in 1748 and soon catapulted into the foremost ranks of German and European banks. Even after the bank's sale in 1976, there are Bethmanns engaged in commercial real estate and forestry in the 21st century.

W

WDumbell's Bank was a bank in the Isle of Man. The bank's insolvency in 1900, known as Black Saturday and referred to in the Isle of Man as the Dumbell's Bank Crash, resulted in a run on the bank with many individuals losing their life savings and the ruin of numerous local businesses causing poverty, depression and bankruptcy. The effects were profound and lasted for a considerable number of years.

W

WThe European Association for Banking and Financial History (eabh) is an independent, non-profit association based in Frankfurt am Main. Founded in 1990, the eabh aims to promote research on banking history; support the preservation historically valuable archive material of public and private banking institutions; and facilitate dialogue on key challenges and opportunities to the historical study of finance, insurance, and globalization. It maintains a global network of financial professionals and academics who meet to discuss and encourage projects in the field of financial and banking history. The eabh currently has 80 member organisations.

W

WThe early history of private equity relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.

W

WThe Fould family is a family of French Jewish descent known for success in banking. It was founded by Beer Léon Fould, a wine-dealer's son from Lorraine, who moved to Paris in 1784 to establish a banking business. The name comes from the Hessian city of Fulda.

W

WFugger is a German upper bourgeois family that was historically a prominent group of European bankers, members of the fifteenth- and sixteenth-century mercantile patriciate of Augsburg, international mercantile bankers, and venture capitalists. Alongside the Welser family, the Fugger family controlled much of the European economy in the sixteenth century and accumulated enormous wealth. The Fuggers held a near monopoly on the European copper market.

W

WA gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold foreign central banks, effectively ending the Bretton Woods system. Many states still hold substantial gold reserves.

W

WA goldsmith is a metalworker who specializes in working with gold and other precious metals. Nowadays they mainly specialize in jewelry-making but historically, goldsmiths have also made silverware, platters, goblets, decorative and serviceable utensils, and ceremonial or religious items.

W

WHenry Grunfeld was a merchant banker who played a prominent role in the development of investment banking and the growth of London as a financial centre following the Second World War.

W

WA History of Banking in all the Leading Nations, first published in 1896 by The Journal of Commerce, is a four-volume history of banking in North America, Europe, China and Japan. At the time of publication it was described as "the largest and most expensive treatise on banking yet published". Thirteen authors contributed to the work, all of whom were considered "eminent as bankers, financiers and political economists". The title page bears the notice "Edited by the Editor of The Journal of Commerce and Commercial Bulletin".

W

WThe history of private equity and venture capital and the development of these asset classes has occurred through a series of boom-and-bust cycles since the middle of the 20th century. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel, although interrelated tracks.

W

WHope & Co. is the name of a famous Dutch bank that spanned two and a half centuries. Though the founders were Scotsmen, the bank was located in Amsterdam, and at the close of the 18th century it had offices in London as well. The bank was famous for having as their most important client Catherine the Great of Russia, the King of Portugal and having played a major part in the finances of the Dutch East India Company (VOC) through Henry Hope. The Hope Family were among the richest men in Europe at the time. .

W

WHenry Hope (1735–1811) was an Amsterdam merchant banker born in Boston, in Britain's Massachusetts Bay Colony in North America.

W

WHottinger first appears in the annals of the town of Zöllikon, near Zurich, in 1362. The town had recently joined the Swiss Confederation, and was poised to become a thriving center for trade. In 1401, three members of the Hottinger family were named Grand Burghers of the city. Their names Hans, Heinrich and Rudolf – or, in their French variants, Jean, Henri and Rodolphe – have marked the family dynasty for over 500 years. During the 15th and 16th centuries, their descendants oversaw the canton's progressive transformation from a rural to a financial economy, taking an active role in the region's political, cultural and religious life all the way into the 18th century.

W

WIstituto Bancario San Paolo di Torino S.p.A., commonly known as just San Paolo, was an Italian bank. It was headquartered in Turin, Piedmont. The bank is the predecessor of Sanpaolo IMI, as well as the current largest bank in Italy in terms of total assets, Intesa Sanpaolo. The former owner of San Paolo bank, Compagnia di San Paolo, still significantly owned Intesa Sanpaolo.

W

WJohn Law was a Scottish economist who distinguished money, a means of exchange, from national wealth dependent on trade. He served as Controller General of Finances under the Duke of Orleans, who was regent for the juvenile Louis XV of France. In 1716, Law set up a private Banque Générale in France. A year later it was nationalised at his request and renamed as Banque Royale. The private bank had been funded mainly by John Law and Louis XV; three-quarters of its capital consisted of government bills and government-accepted notes, effectively making it the nation's first central bank. Backed only partially by silver, it was a fractional reserve bank. Law also set up and directed the Mississippi Company, funded by the Banque Royale. Its chaotic collapse has been compared to the 17th-century tulip mania in Holland. The Mississippi bubble coincided with the South Sea bubble in England, which allegedly took ideas from it. Law as a gambler would win card games by mentally calculating odds. He originated ideas such as the scarcity theory of value and the real bills doctrine. He held that money creation stimulated an economy, paper money was preferable to metal, and dividend-paying shares a superior form of money. The term "millionaire" was coined for beneficiaries of Law's scheme.

W

WLombard banking was a mount of piety style of pawn shop in the Middle Ages, a type of banking that originated in prosperous Northern Italy, in a region called Lombardy during the Middle Ages. The term was sometimes used in a derogatory sense, and some Lombardy bankers were accused of usury.

W

WLombard Street is a street notable for its connections with the City of London's merchant, banking and insurance industries, stretching back to medieval times.

W

WEsq. Nicholas Magens or Nicolaus Paul Magens was an attorney, a merchant on Spain and her colonies in America, and an expert on ship insurance, general average and bottomry who gained a great reputation in commercial matters.

W

WThe Merck family is a German family of industrialists and bankers, known for establishing the world's oldest pharmaceutical company Merck, its American former subsidiary Merck & Co. (MSD), which is now an independent company, as well as the Hamburg merchant bank H. J. Merck & Co. The family still owns the majority of the pharmaceutical company Merck.

W

WMichael Robert Milken is an American financier, philanthropist and presidentally pardoned felon. He is noted for his role in the development of the market for high-yield bonds, and his conviction and sentence following a guilty plea on felony charges for violating U.S. securities laws. Milken's compensation while head of the high-yield bond department at Drexel Burnham Lambert in the late 1980s exceeded $1 billion over a four-year period, a record for U.S. income at that time. With an estimated net worth of around $3.7 billion as of 2018, he is ranked by Forbes magazine as the 606th richest person in the world.

W

WBanca Monte dei Paschi di Siena S.p.A., known as BMPS or just MPS, is an Italian bank. Tracing its history to a mount of piety founded in 1472 and founded in its present form in 1624, it is the world's oldest or second oldest bank, depending on the definition, and the fourth largest Italian commercial and retail bank.

W

WRobert Morris, Jr. was an English-born merchant and a Founding Father of the United States. He served as a member of the Pennsylvania legislature, the Second Continental Congress, and the United States Senate, and he was a signer of the Declaration of Independence, the Articles of Confederation, and the United States Constitution. From 1781 to 1784, he served as the Superintendent of Finance of the United States, becoming known as the "Financier of the Revolution." Along with Alexander Hamilton and Albert Gallatin, he is widely regarded as one of the founders of the financial system of the United States.

W

WA mount of piety is an institutional pawnbroker run as a charity in Europe from Renaissance times until today. Similar institutions were established in the colonies of Catholic countries; the Mexican Nacional Monte de Piedad is still in operation.

W

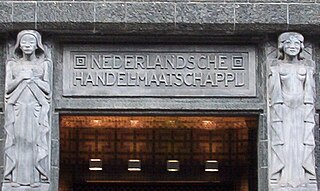

WThe Netherlands Trading Society was a Dutch trading company established in 1824 by King William I of the Netherlands to promote and develop trade, shipping and agriculture. For the next 140 years the NHM developed a large international branch network and increasingly engaged in banking operations, and subsequently would become one of the primary ancestors of ABN AMRO.

W

WThis list of the oldest banks includes financial institutions in continuous operation, operating with the same legal identity without interruption since their establishment until the present time.

W

WPawnbroking, lending money on portable security, began in ancient history. The practice was widespread in many parts of the world, from ancient Greece to medieval China and medieval Europe.

W

WPrivate equity in the 1980s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.

W

WPrivate equity in the 1990s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital, experienced growth along parallel although interrelated tracks.

W

WPrivate equity in the 2000s represents one of the major growth periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital expanded along parallel and interrelated tracks.

W

WThe Rothschild family is a wealthy Ashkenazi Jewish family originally from Frankfurt that rose to prominence with Mayer Amschel Rothschild (1744–1812), a court factor to the German Landgraves of Hesse-Kassel in the Free City of Frankfurt, Holy Roman Empire, who established his banking business in the 1760s. Unlike most previous court factors, Rothschild managed to bequeath his wealth and established an international banking family through his five sons, who established businesses in London, Paris, Frankfurt, Vienna, and Naples. The family was elevated to noble rank in the Holy Roman Empire and the United Kingdom. The family's documented history starts in 16th century Frankfurt; its name is derived from the family house, Rothschild, built by Isaak Elchanan Bacharach in Frankfurt in 1567.

W

WThe silver standard is a monetary system in which the standard economic unit of account is a fixed weight of silver. Silver was far more widespread than gold as the monetary standard worldwide, from the Sumerians c. 3000 BCE until 1873. Following the discovery in the 16th century of large deposits of silver at the Cerro Rico in Potosí, Bolivia, an international silver standard came into existence in conjunction with the Spanish pieces of eight. These silver dollar coins played the role of an international trading currency for nearly four hundred years.

W

WThe Smith family is an English aristocratic and banking family founded by Thomas Smith (1631–1699), the founder of Smith's Bank of Nottingham. Its members include the Marquess of Lincolnshire (extinct), the Viscount Wendover (extinct), the Barons Carrington, the Baron Pauncefote (extinct), the Barons Bicester, the Bromley baronets and many Members of Parliament. Originally named Smith, the branch of the Barons Carrington assumed the surname Carington, the branch of the Bromley baronets the surname Bromley and the branch of the Baron Pauncefote the surname Pauncefote.

W

WThe South Sea Company was a British joint-stock company founded in January 1711, created as a public-private partnership to consolidate and reduce the cost of the national debt. To generate income, in 1713 the company was granted a monopoly to supply African slaves to the islands in the "South Seas" and South America. When the company was created, Britain was involved in the War of the Spanish Succession and Spain and Portugal controlled most of South America. There was thus no realistic prospect that trade would take place, and as it turned out, the Company never realised any significant profit from its monopoly. However, Company stock rose greatly in value as it expanded its operations dealing in government debt, and peaked in 1720 before suddenly collapsing to little above its original flotation price. The notorious economic bubble thus created, which ruined thousands of investors, became known as the South Sea Bubble.

W

WThe Stadsleenbank Delft is a former Bank van Lening on the Burgwal 45 in Delft, and serves today as a pop music podium for concerts. The gable stone is inscribed '1769 Den Ingangh van de Stadsleenbanck', whereby "Den Ingangh" means entrance. Delft first received rights for a city lombard or "lommerd" bank in 1287 from Floris V. In 1367 similar rights "as in Delft" were granted to Haarlem by Albert I, Duke of Bavaria. The Lombard bankers sold out to the city council in 1676, and the bank functioned until 1923 when it was dissolved. The archives 1676-1923 were only partially retained and were inventoried in 1970 and are today in the collection of the city of Delft.

W

WGiovanni Villani was an Italian banker, official, diplomat and chronicler from Florence who wrote the Nuova Cronica on the history of Florence. He was a leading statesman of Florence but later gained an unsavoury reputation and served time in prison as a result of the bankruptcy of a trading and banking company he worked for. His interest in and elaboration of economic details, statistical information, and political and psychological insight mark him as a more modern chronicler of late medieval Europe. His Cronica is viewed as the first introduction of statistics as a positive element in history. However, historian Kenneth R. Bartlett notes that, in contrast to his Renaissance-era successors, "his reliance on such elements as divine providence links Villani closely with the medieval vernacular chronicle tradition." In recurring themes made implicit through significant events described in his Cronica, Villani also emphasized three assumptions about the relationship of sin and morality to historical events, these being that excess brings disaster, that forces of right and wrong are in constant struggle, and that events are directly influenced by the will of God.