W

W1LINK (Guarantee) Limited is a consortium of major banks that own and operate the largest representative interbank network in Pakistan and is incorporated under the Company Law, Section 42 by Security and Exchange Commission of Pakistan (SECP). 1LINK is converted to Private Limited Company under section 49 of Companies Act 2017 on July 5, 2018.

W

WAccuSystems LLC is an American company headquartered in Pueblo, Colorado that develops, licenses, supports, and sells document imaging software and electronic document management, primarily to the banking and finance industries. It was founded by Mel Hatch. Over 200 banks use AccuSystems' software.

W

WAn automated teller machine (ATM) or cash machine is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, or account information inquiries, at any time and without the need for direct interaction with bank staff.

W

WBackoff is a kind of malware that targets point of sale (POS) systems. It is used to steal credit card data from point of sale machines at retail stores. Cybercriminals use Backoff to gather data from credit cards. It is installed via remote desktop type applications where POS systems are configured. It belongs to the POS malware family as it is known to scrape the memory of POS devices.

W

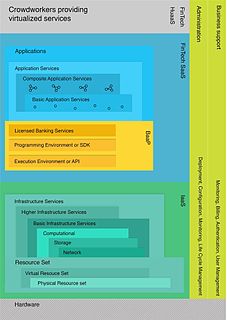

WBanking as a service (BaaS) is an end-to-end process ensuring the overall execution of a financial service provided over the web. Such a digital banking service is available on-demand and operates within a set time-frame.

W

WCenter of Financial Technologies (CFT) is a Russian software company that provides software solutions and services to financial, healthcare and public sectors. It has been described as "Russia’s national payment system ". It is among the five largest software developing companies operating on the CIS market.

W

WCheque truncation is a cheque clearance system that involves the digitalisation of a physical paper cheque into a substitute electronic form for transmission to the paying bank. The process of cheque clearance, involving data matching and verification, is done using digital images instead of paper copies.

W

WContactless payment systems are credit cards and debit cards, key fobs, smart cards, or other devices, including smartphones and other mobile devices, that use radio-frequency identification (RFID) or near field communication for making secure payments. The embedded integrated circuit chip and antenna enable consumers to wave their card, fob, or handheld device over a reader at the point of sale terminal. Contactless payments are made in close physical proximity, unlike mobile payments which use broad-area cellular or WiFi networks and do not involve close physical proximity.

W

WA contactless smart card is a contactless credential whose dimensions are credit-card size. Its embedded integrated circuits can store data and communicate with a terminal via NFC. Commonplace uses include transit tickets, bank cards and passports.

W

WCryptography, or cryptology, is the practice and study of techniques for secure communication in the presence of third parties called adversaries. More generally, cryptography is about constructing and analyzing protocols that prevent third parties or the public from reading private messages; various aspects in information security such as data confidentiality, data integrity, authentication, and non-repudiation are central to modern cryptography. Modern cryptography exists at the intersection of the disciplines of mathematics, computer science, electrical engineering, communication science, and physics. Applications of cryptography include electronic commerce, chip-based payment cards, digital currencies, computer passwords, and military communications.

W

WA currency-counting machine is a machine that counts money—either stacks of banknotes or loose collections of coins. Counters may be purely mechanical or use electronic components. The machines typically provide a total count of all money, or count off specific batch sizes for wrapping and storage.

W

WDinarak is a mobile wallet, money transfer, electronic bill payment, funds disbursement service, licensed by the Central Bank of Jordan under the JoMoPay national switch and launched in late 2015 as Dinarak wallet as part of the Jordanian central bank's efforts to advocate financial inclusion for the un-banked segment of the Jordanian population. Dinarak allows users to deposit, withdraw, transfer money and pay for goods and services via their mobile phone. The service can be accessed by Dinarak mobile application.

W

WFaster Payment System is a real-time gross settlement payment system in Hong Kong that connects traditional banks and electronic payment and digital wallet operators. Users are able to perform instant money transfer or make payment to merchants by using the recipient's phone number, e-mail or QR code that contains the user's numeric identifier. Using the "traditional way" of full name and account number to make interbank transfer is also allowed.

W

WFaster Payments Service (FPS) is a United Kingdom banking initiative to reduce payment times between different banks' customer accounts to typically a few seconds, from the three working days that transfers usually take using the long-established BACS system. CHAPS, which was introduced in 1984, provides a limited faster-than-BACS service for "high value" transactions, while FPS is focused on the much larger number of smaller payments, subject to limits set by the individual banks, with some allowing Faster Payments of up to £250,000. Transfer time, while expected to be short, is not guaranteed, nor is it guaranteed that the receiving institution will immediately credit the payee's account.

W

WFinacle is a core banking product developed by the Infosys that provides universal Digital banking functionality to banks. In August 2015, Finacle became part of EdgeVerve Systems Limited, a wholly owned product subsidiary of Infosys.

W

WInstant payment notification (IPN) is a method for online retailers to automatically track purchases and other server-to-server communication in real time. This allows E-commerce systems the opportunity to store payment transactions, order information and other sales internally. IPN messages can represent payment success or failures, order transaction status changes, accounting ledger information and many others depending on the payment gateway.

W

WLIXI is an Australian, member-based not-for-profit company that develops data message transaction standards for the Australian mortgage processing industry, and promotes improvements in efficiency in mortgage processing. Owned by the members of the initiative, LIXI represents participants in the residential mortgage lending industry. Founded in 2001, LIXI has developed and released standards for such transactions as mortgage applications, property valuations, broker commissions and several others.

W

WMagnetic ink character recognition code, known in short as MICR code, is a character recognition technology used mainly by the banking industry to streamline the processing and clearance of cheques and other documents. MICR encoding, called the MICR line, is at the bottom of cheques and other vouchers and typically includes the document-type indicator, bank code, bank account number, cheque number, cheque amount, and a control indicator. The format for the bank code and bank account number is country-specific.

W

WA magnetic stripe card is a type of card capable of storing data by modifying the magnetism of tiny iron-based magnetic particles on a band of magnetic material on the card. The magnetic stripe, sometimes called swipe card or magstripe, is read by swiping past a magnetic reading head. Magnetic stripe cards are commonly used in credit cards, identity cards, and transportation tickets. They may also contain an RFID tag, a transponder device and/or a microchip mostly used for business premises access control or electronic payment.

W

WA money changer is a person or organization whose business is the exchange of coins or currency of one country, for that of another. This trade was a predecessor of modern banking.

W

WOpayo, formerly Sage Pay, is a payments processing service that is owned by Elavon that operates in the UK and Ireland. The company provides online payments processing as well as products for face-to-face and telephone payments. It was known by the name Sage Pay while under the ownership of The Sage Group plc between 2006 and 2020, when the payments company had also expanded to Germany, Spain, South Africa and the United States.

W

WA payment terminal, also known as a Point of Sale (POS) terminal, credit card terminal, EFTPOS terminal, is a device which interfaces with payment cards to make electronic funds transfers. The terminal typically consists of a secure keypad for entering PIN, a screen, a means of capturing information from payments cards and a network connection to access the payment network for authorization.

W

WPublic-key cryptography, or asymmetric cryptography, is a cryptographic system that uses pairs of keys: public keys, which may be disseminated widely, and private keys, which are known only to the owner. The generation of such keys depends on cryptographic algorithms based on mathematical problems to produce one-way functions. Effective security only requires keeping the private key private; the public key can be openly distributed without compromising security.

W

WA smart card, chip card, or integrated circuit card is a physical electronic authorization device, used to control access to a resource. It is typically a plastic credit card-sized card with an embedded integrated circuit (IC) chip. Many smart cards include a pattern of metal contacts to electrically connect to the internal chip. Others are contactless, and some are both. Smart cards can provide personal identification, authentication, data storage, and application processing. Applications include identification, financial, mobile phones (SIM), public transit, computer security, schools, and healthcare. Smart cards may provide strong security authentication for single sign-on (SSO) within organizations. Numerous nations have deployed smart cards throughout their populations.

W

WThe substitute check is a negotiable instrument that represents the digital reproduction of an original paper check. As a negotiable payment instrument in the United States, a substitute check maintains the status of a "legal check" in lieu of the original paper check as authorized by the Check Clearing for the 21st Century Act. Instead of presenting the original paper checks, financial institutions and payment processing centers transmit data from a substitute check electronically through either the settlement process, the United States Federal Reserve System, or by clearing the deposit based on a private agreement between member financial institutions of a clearinghouse that operates under the Uniform Commercial Code (UCC).

W

WTillie the All-Time Teller was one of the first ATMs, run by the First National Bank of Atlanta and considered to be one of the most successful ATMs in the banking industry. Tillie the All-Time Teller had a picture of a smiling blonde girl on the front of the machine to suggest it was user-friendly, had an apparent personality, and could greet people by name. Many banks hired women dressed as this person to show their customers how to use Tillie the All-Time Teller.

W

WZafin is a banking software enterprise platform company that provides relationship-based pricing to banks and financial institutions.