W

WA commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

W

WThe Halle aux blés was a circular building in central Paris used by grain traders built in 1763–67, with an open-air interior court that was capped by a wooden dome in 1783, then by an iron dome in 1811. In a major reconstruction in 1888–89 much of the structure was replaced and the building became the Bourse de commerce. The structure influenced the design of public buildings in Britain and the United States.

W

WEn primeur or "wine futures", is a method of purchasing wines early while the wine is still in the barrel. This offers the customer the opportunity to invest before the wine is bottled. Payment is made at an early stage, a year or 18 months prior to the official release of a vintage. A possible advantage of buying wines en primeur is that the wines may be considerably cheaper during the en primeur period than they will be once bottled and released to the market. However, that is not guaranteed and some wines may lose value over time. Wine experts, like Tom Stevenson, recommend buying en primeur for wines with very limited quantities and will most likely not be available when they are released. The wines most commonly offered en primeur are from Bordeaux, Burgundy, the Rhône Valley and Port, although other regions are adopting the practice.

W

WAn exchange, bourse, trading exchange or trading venue is an organized market where (especially) tradable securities, commodities, foreign exchange, futures, and options contracts are bought and sold.

W

WFundamental analysis, in accounting and finance, is the analysis of a business's financial statements ; health; and competitors and markets. It also considers the overall state of the economy and factors including interest rates, production, earnings, employment, GDP, housing, manufacturing and management. There are two basic approaches that can be used: bottom up analysis and top down analysis. These terms are used to distinguish such analysis from other types of investment analysis, such as quantitative and technical.

W

WThe Good Delivery specification is a set of rules issued by the London Bullion Market Association (LBMA) describing the physical characteristics of gold and silver bars used in settlement in the wholesale London bullion market. It also puts forth requirements for listing on the LBMA Good Delivery List of approved refineries.

W

WKlöckner & Co SE is a German producer-independent steel and metal distributor. Klöckner's core business is the sale of steel and non-ferrous metals. The company has an established distribution network and some 150 locations.

W

WKloeckner Metals Corporation is a steel and metal distributor based in Roswell, Georgia. Kloeckner Metals Corporation's core business is the sale of steel and non-ferrous metals. The North American subsidiary of Klöckner & Co SE, Kloeckner Metals Corporation is the fourth-largest service center company in North America with 50 locations in North America servicing 8,000 metalworking businesses in the United States, Puerto Rico, Mexico, and Canada. In 2016, Kloeckner Metals Corporation reported sales of $2.6 billion.

W

WThe Korenbeurs was a 17th-century commodity market in Amsterdam where grain was traded. The building stood on the banks of the Amstel, on the western side (Nieuwezijde) of the Damrak. It was directly south of the Oude Brug bridge, on a spot now occupied by the former stock and commodity exchange Beurs van Berlage.

W

WMulti Commodity Exchange of India Ltd (MCX) is a commodity exchange based in India. It is under the ownership of Ministry of Finance, Government of India. It was established in 2003 by the Government of India and is currently based in Mumbai. It is India's largest commodity derivatives exchange. The average daily turnover of commodity futures contracts increased by 26% to ₹32,424 crore during FY2019-20, as against ₹25,648 crore in FY2018-19. The total turnover of commodity futures traded on the Exchange stood at ₹83.98 lakh crore in FY2019-20. MCX offers options trading in gold and futures trading in non-ferrous metals, bullion, energy, and a number of agricultural commodities.

W

WPork belly is a boneless and fatty cut of meat from the belly of a pig. Pork belly is particularly popular in Hispanic, Chinese, Danish, Norwegian, Korean, Thai and Filipino cuisine.

W

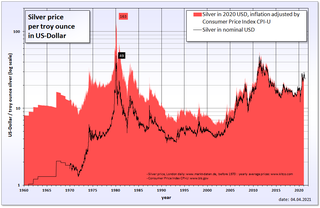

WSilver Thursday was an event that occurred in the United States silver commodity markets on Thursday, March 27, 1980, following the attempt by brothers Nelson Bunker Hunt, William Herbert Hunt and Lamar Hunt to corner the silver market. A subsequent steep fall in silver prices led to panic on commodity and futures exchanges.

W

WThe State Reserves Bureau Copper Scandal refers to a loss of approximately US$150 million as a result of trading LME Copper futures contracts at the London Metal Exchange (LME) by rogue trader Liu Qibing, who was the chief trader for the Import and Export Department of the State Regulation Centre for Supply Reserves (SRCSR), the trading agency for the State Reserve Bureau (SRB) of China in 2005.

W

WA trader is a person, firm, or entity in finance who buys and sells financial instruments, such as forex, cryptocurrencies, stocks, bonds, commodities, derivatives, and mutual funds in the capacity of agent, hedger, arbitrageur, or speculator.

W

WThe uranium market, like all commodity markets, has a history of volatility, moving with the standard forces of supply and demand as well as geopolitical pressures. It has also evolved particularities of its own in response to the unique nature and use of uranium.